Payroll - W-2 Calculation

Function

This task is used to calculate the W-2 information for later use by the W-2 Printing, W-2 Export, and W-2 E-File operations.

NOTE: The W-2 Calculation task may be run as often as desired. If you have made changes to Information in the "Report Parameters" or "Employee Records" relating to information or form type to be reported, you must also re-run this task. You do not need to rerun this task to reprint/reprocess historical data.

=> To access this task...

Select W2 Processing from the Periodic Processing menu, then select W-2 Calculation.

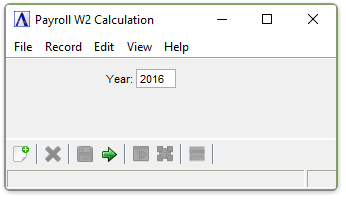

W2 Calculation

About the Fields

In the Year field...

- Enter the Calendar Tax Year being processing.

When done making selections...

- Click the

to process the requested action.

to process the requested action.

If data is already present for the year in question, you will be asked for confirmation.

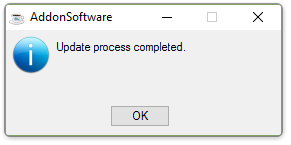

When the calculation is complete, you will be prompted.

When the process is complete, you are returned to the Payroll W2 Process Menu.

Note: This Process will always create a Safety Copy of the W2 Work file prior to generating a new calculation. The Copied File will have a date and time stamp appended to its name.

If you receive this message, please contact your AddonSoftware Dealer for the necessary updates. The W2 Calculation Process and Program varies from Tax year to Tax Year, as such a specific program is used for a specific tax year.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.