Payroll - Application Parameters

Function

Payroll parameters determine the way an individual business processes its payroll. The parameters in Payroll Maintenance are divided into two options: System Parameters and Report Parameters. System Parameters must be set up first as they are required for entry to any other Payroll programs. Then after establishing the codes required, set up Report Parameters. Consult your AddonSoftware Dealer before making any changes once the Payroll module is in operation.

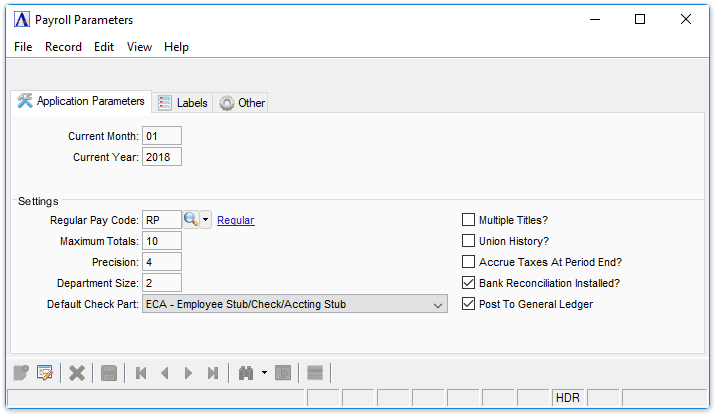

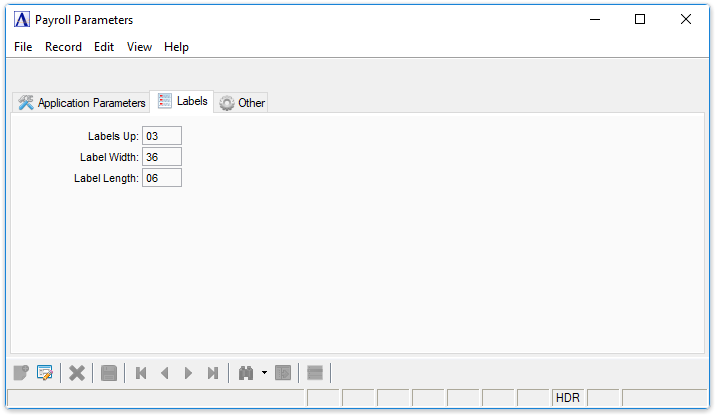

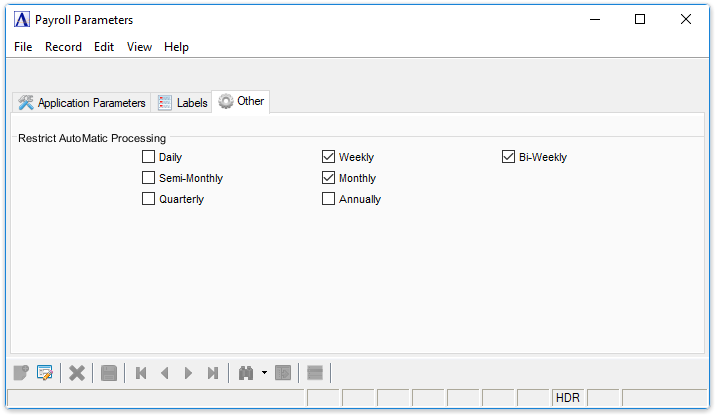

The Payroll Parameter Maintenance form is divided into three tabs. The Application Parameters tab controls the Payroll Current Period and System Settings. The Labels tab defines the settings for printing labels. The Other tab provides restrictions to automated processing through the use of checkboxes.

=>To access this task...

Select Application Parameters from the Inquiry and Maintenance menu.

Payroll System Parameters

The Payroll parameters must be defined as part of the Payroll module installation and are generally not modified later. When changing the parameters without the assistance of the dealer, study the parameter information in the Installation section carefully before making any changes.

Payroll Parameters

About the Fields

To Enable Edits to the form select  .

.

Application Parameters Tab

In the Current Month field...

-

Enter the current calendar month, for Payroll.

Note: Payroll is Based upon Calendar Month and the actual Check Date determines the subject reporting period for the Employee/Employer Tax Records..

General Ledger Postings will follow the Fiscal Year Definition in the General Ledger System.

In the Current Year field...

-

Enter the current calendar year.

Settings

In the Regular Pay Code field...

-

Enter a pay code to be used for automatic pay generation.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the Maximum Totals field...

-

Enter the maximum number of pay codes, deductions, and/or tax codes that normally would be printed on each pay check.

In the Precision field...

This primarily affects the fractional parts of units/hours. Dollar Calculations are always rounded to cents.

-

Enter the number of decimal places to carry out all payroll calculations.

In the Dept Size field...

During report printing, the actual department that an employee is assigned to currently, in the Employee Master File determines which department they are reported in, a department subtotal is printed on the payroll reports.

-

Enter an amount indicating how many of the initial digits of the employee number constitute the employee’s department. Two digits are recommended.

From the Default Check Part dropdown...

This selection controls the default value of the "Form Part Order" List Button on the Check Printing option entry form. Checks are printed in three parts: Employee Stub, Payroll Check, and Accounting (in-house) stub. Use this selection to match the printing of the three parts to the parts on the check paper stock.

-

ECA - Employee Stub/Check/Accounting Stub

-

CEA - Check/Employee Stub/Accounting Stub

-

ACE - Accounting Stub/Check/Employee Stub

-

AEC - Accounting Stub/Employee Stub/Check

Multiple Titles checkbox...

-

Mark the box to allow calculation of pay using rate from title code, if the title code is not set-up with a rate on an employee.

-

Unmark the box if only titles set up in the employee/pay rate maintenance may be used for an employee

Union History checkbox...

-

Mark the box to allow the definition of union codes in which pay, tax, and contribution codes are specified.

-

Unmark the box to ignore union history.

Accrue Taxes At Payroll Period End checkbox...

For more information about how taxes are accrued, refer to Appendix G.

-

Mark the box if taxes are to be accrued as of each pay period ending date.

-

Unmark the box if taxes are to be accrued as of each check date.

Bank Reconciliation Installed checkbox...

-

Mark the box if the bank reconciliation system is installed and payroll update to bank reconciliation is required.

-

Unmark the box if the bank reconciliation system is not installed, or a payroll update to bank reconciliation is not required.

Post to General Ledger checkbox...

-

Mark the box if the General Ledger System is Installed and payroll update to the General Ledger are required.

-

Unmark the box if the General Ledger System is not installed or payroll update to the General Ledger is not required.

Labels Tab

Payroll Parameters Labels tab

In the Labels Up field...

-

Enter the number of labels to print across a page on continuous label sheets.

In the Label Length field...

-

Enter the length of the label in Rows.

In the Label Width field...

-

Enter the width of the label in Columns.

Other Tab

Payroll Parameters Other tab

Restrict AutoMatic Processing checkboxes...

Selection of the related periods will restrict AutoMatic Processing to just those periods allowed by this selection. When Automatic Processing is Selected in the Daily Processing, even it additional periods are selected. For instance, if only Monthly is checked here, and in the Daily Processing Selection, you select both Weekly and Monthly, only the Monthly Pay-Period defined employee's will have automatic entries created for them.

When finished entering Payroll Parameter Information...

-

Click

to save the record.

to save the record. -

Click

to delete the record selected.

to delete the record selected.

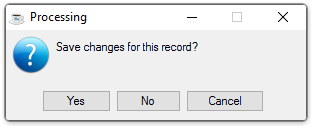

If the Window is closed without saving the record, the module issues this confirmation prompt:

-

Click [Yes] to save the changes.

-

Click [No] to return to the Payroll Maintenance Menu without saving the record.

-

Click [Cancel] to return to the Payroll Parameter Maintenance Screen.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.