Payroll - Report Parameters

Function

The Report Parameters option of the Parameters maintenance task defines and maintains the company name and address for printing government payroll reports and forms. It also specifies the tax, contribution, and deduction codes necessary for complete W-2 reporting. Bank Account Information that is printed on the Payroll Check, as well as information needed for EFT is also specified. The form has three tabs - Tax Codes, Federal Tax Filing Info, and ACH and Banking Info.

=>To access this task...

Select Report Parameters from the Inquiry and Maintenance menu.

Payroll Report Parameters

The Payroll Report parameters must be defined as part of the Payroll module installation and are generally not modified later. When changing the parameters without the assistance of the dealer, study the parameter information in the Installation section carefully before making any changes.

WARNING: The federal, state, and local tax codes that are to be used must be established before Report Parameters since entry of these codes will be validated (Refer to Tax Code Maintenance). The 941 Code field must have an entry and your system will lock up if an established code is not available.

To properly display the MICR Font, the MICR True Type font must also be installed on your workstation.

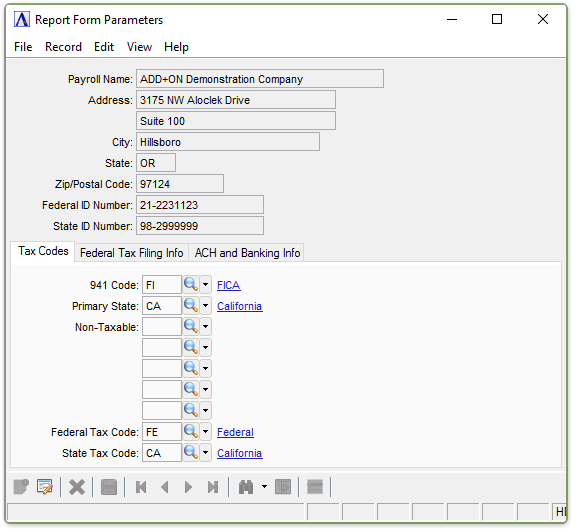

Report Form Parameters

About the Fields

The Report Form Parameters screen is divided into two sections. The upper section (header) fields are used to enter the employer name, address, and tax id numbers.

To Enable Edits to the form select  .

.

In the Payroll Name field...

This name is printed on W-2 Forms and Union History Reports.

-

Enter a company name of up to 30 characters to be used for payroll reporting purposes.

In the Address fields...

-

Enter a street address of up to 24 characters for the company.

In the City field...

-

Enter a name of up to 22 characters for the city in which the company is located.

In the State field...

-

Enter the 2-character postal ID code of the state in which the company is located.

In the Zip/Postal Code field...

-

Enter the company’s zip code as either a 5-digit or a 9-digit code, as defined in the System Parameters option.

In the Federal ID Number field...

-

Enter a maximum of 9 digits to be used as the employer identification number on W‑2 forms. (only digits 0-9 and "−" may be entered).

In the State ID Number field...

Although state reporting may not be currently required by the company’s resident state, this field is provided to meet any future requirements.

-

Enter a maximum of 15 characters to be used as the employer identification on the State Quarterly Tax forms and W-2 forms.

Tax Codes Tab

Function

The Tax Codes tab allows for the inquiry and maintenance of tax code information that pertains to the Employer.

Report From Parameters - Tax Codes tab

In the 941 Code field...

This is the FICA code to be used for Federal tax reports. This code is not currently used, but is provided to meet any future requirements. An entry in this field is required.

-

Enter a valid tax code.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the Primary State field...

-

Enter the tax code for the primary state’s income tax withholding.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the Non-Taxable fields...

Selected earnings are subtracted from the state taxable earning basis. Currently, this applies to California only.

-

Enter up to five state tax codes that are not to be included on the state tax forms (refer to your State Tax Guide).

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the Federal Tax Code field...

-

Enter the 2-character default federal tax code defined in the Tax Code Maintenance task that is used to compute federal withholding tax.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the State Tax Code field...

-

Enter the 2-character state tax code defined in the Tax Code Maintenance task that is used as the primary state withholding tax.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

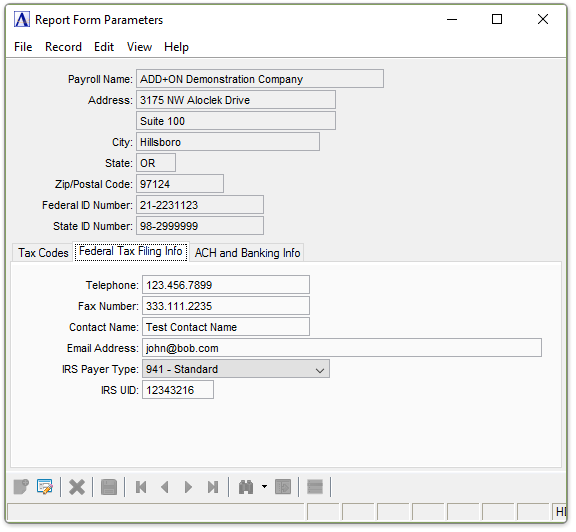

Federal Tax Filing Info Tab

Function

The Federal Tax filing info tab allows for the inquiry and maintenance of tax information necessary for E-Filing of Tax Forms. When payroll is processed for multiple states, this entry should be the state in which the business resides (i.e., the company headquarters). An entry in this field is required.

Report From Parameters - Federal Tax Filing Info tab

In the Telephone field...

-

Enter the Business Telephone Number to be printed on the Payroll Checks. It may be left blank.

In the Fax Number Field...

-

Enter the Business Fax Telephone Number to be printed on the Payroll Checks. It may be left blank.

In the Contact Name Field...

-

Enter the Name of the Person that is assigned as the Contact Person for E-Filing of Wage and Tax Statements.

In the Email Address Field...

-

Enter the E-Mail address of the Person that is assigned as the Contact Person for E-Filing of Wage and Tax Statements.

From the IRS Payer Type dropdown...

Enter one of the following to specify the Employer Type for E-Filing and W3 printing.

-

Select 941 - Standard for a Regular Employer

-

Select 943 - Agricultural for an Agricultural Employer.

-

Select 944 - For an Annual Non-Profit Employer.

In the IRS UID field...

-

Enter the User ID code assigned by the Social Security Administration - Business Services Online, to the Contact Person Listed above.

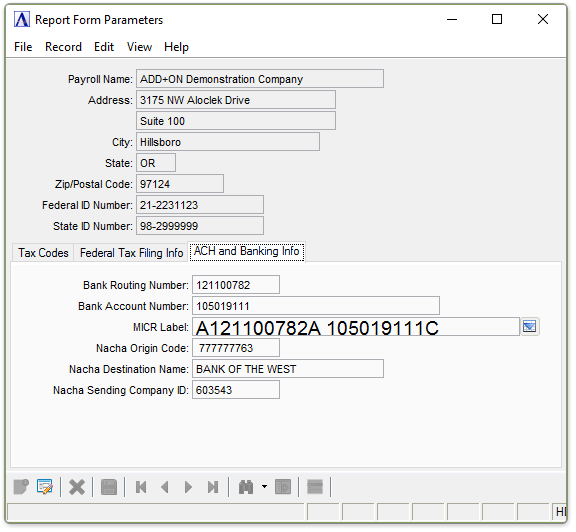

ACH and Banking Info Tab.

Function

The ACH and Banking Info tab allows for the inquiry and maintenance of banking information necessary for Direct Deposit and Check Printing.

Report Form Parameters - ACH and Banking Info tab

In the Bank Routing Number field...

-

Enter the Bank Routing Number used for EFT.

In the Bank Account Number field...

-

Enter the Bank Account Number used for EFT.

In the MICR Label field...

-

Enter what is normally the Bank Routing Number and Bank Account Number that appears on the bottom of a Check.

-

Click

to select a Drill Down - Font Code Lookup Table to include specific font codes.

to select a Drill Down - Font Code Lookup Table to include specific font codes.

The Check Number Portion will be automatically added during Check Printing. Normally: This is a Repeat of the Bank Routing Number and Account Number, but sometimes differs, due to Bank Mergers and Acquisitions.

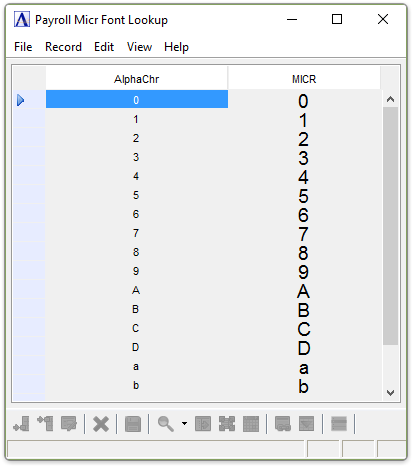

MICR Font Lookup

Note: You must have the MICR True Type Font installed on your Workstation to Properly See the Characters.

If you see this instead, then the MICR True Type Font is not installed.

The MICR Font used for Check Printing is not dependent upon you having the MICR Font installed on your Workstation.

In the Nacha Origin Code field...

-

This is the specified "Immediate Origin" aka assigned Company ID code specified by your ACH Banking Partner.

-

Typically "1" plus your Federal Tax Id buy may have an alternative coding.

In the Nacha Destination Name field...

-

This is the specified "Immediate Destination Name" as specified by your ACH Banking Partner.

-

Typically the banks official name as specified by the US Treasury Department.

In the Nacha Sending Company ID field...

-

This is your Company ID as assigned by your ACH Banking Partner.

When finished entering Payroll Report Parameter Information...

-

Click

to save the record.

to save the record. -

Click

to delete the record selected.

to delete the record selected.

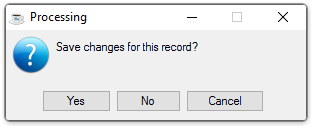

If the Window is closed without saving the record, the module issues this confirmation prompt:

-

Click [Yes] to save the changes.

-

Click [No] to return to the Payroll Maintenance Menu without saving the record.

-

Click [Cancel] to return to the Payroll Report Parameter Maintenance Screen being edited.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.