Payroll - Total Codes

Function

This task defines and maintains up to 99 numeric total codes. Totals accumulate earnings, deductions, taxes, and contributions during the payroll calculation process and become the basis on which deductions, taxes, or contributions are calculated (e.g., for taxes or contributions based on a percentage of dollars earned or units of time worked). The Display additional options... button provides additional features.

=> To access this task...

Select Total Codes from the Inquiry and Maintenance menu.

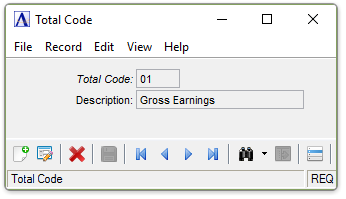

Total Code maintenance

About the Fields

Use this task to create, change, or delete total codes. Total codes identify accumulators used in the payroll calculation. These accumulators store amounts used for intermediate calculations. For example, assume total code 01 is defined as gross dollars earned and total code 02 is defined as taxable dollars earned from which pre-tax deductions were subtracted. A deduction is calculated on the employee’s gross dollars earned so the basis on which the deduction is calculated is total code 01. When a tax is calculated on the employee’s gross dollars earned minus the deduction, the taxable earning basis is total code 02. Refer to Appendix C for additional information.

In the Total Code field...

-

Enter a 2-character total code.

-

Click

to select from a list of all valid total codes.

to select from a list of all valid total codes. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

When the code is already defined, the current information is displayed.

NOTE: In some payroll systems, only a gross dollars earned total code is required, but often there are other requirements, such as taxes or accruals that are based on a specific combination of dollars earned or a combination of dollars earned and deductions, contributions, or taxes. Consult with a tax professional or contact you AddonSoftware dealer if there are questions regarding the totals required.

In the Description field...

This description is for internal reference only and does not print on pay checks or Payroll reports.

-

Enter a maximum of 20 characters to describe this total code (e.g., gross dollars earned, taxable dollars earned, etc.).

When finished entering Total Code Information...

-

Click

to save the record.

to save the record. -

Click

to clear the form and begin again.

to clear the form and begin again. -

Click

to delete the record selected.

to delete the record selected.

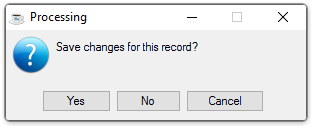

If the Window is closed without saving the record, the module issues this confirmation prompt:

-

Click [Yes] to save the changes.

-

Click [No] to return to the Payroll Maintenance Menu without saving the record.

-

Click [Cancel] to return to the Total Code being edited.

Selecting the Display additional options... button  presents the option to create a listing of all Total Codes

presents the option to create a listing of all Total Codes

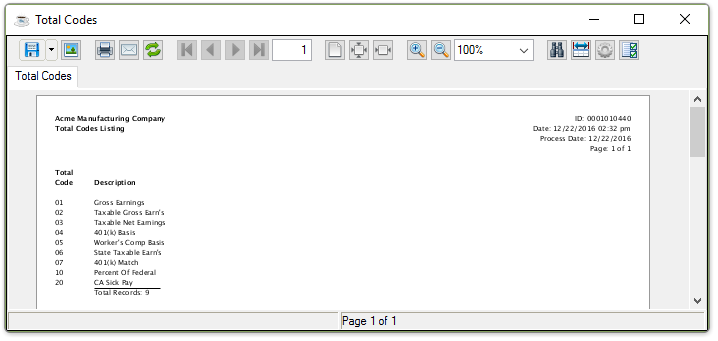

Selecting this option creates the report:

Sample Total Code Listing

See Output Options

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.