Payroll Calculation

Function

This task is used to automatically calculate all deductions, taxes, employer contributions and accruals, based on earnings and deduction information entered through the Payroll Entry task and on earnings generated through the Automatic Processing option of Payroll Period Definition task. The calculation must be run and the update performed for the generation of certain reports. Only computer checks are affected; no calculations are performed for manual checks or check reversals.

=> To access this task...

Select Payroll Calculation from the Daily Processing menu.

NOTE: Since the Payroll Calculation task computes and creates deductions, taxes, employer contributions, and accruals, no information is available for the Payroll Deduction, Tax, Contribution and Accrual Reports until the update in this task is performed.

-

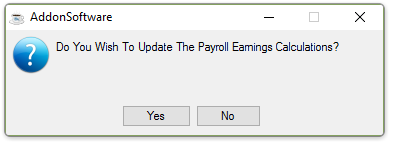

Click [Yes] to process the update.

-

Click [No] to return to the Payroll Daily Processing Menu without completing the update.

If batching has been enabled then you will be presented with the Process Batch Control Screen, to select an existing batch. Batching allows several people to work within the payroll system at the same time on a different set of processes. The batch number assigned carries through the Daily Processing Menu Choices.

Process Batch Control

If Check Printing is in progress for this batch, then recalculation is prevented.

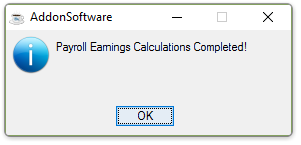

When the calculation is complete, you will be prompted.

When the process is complete, you are returned to the Payroll Daily Processing Menu.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.