Payroll - Pay Codes Maintenance

Function

The Pay Code Maintenance task defines and maintains employee pay codes. Pay codes that apply to all employees (e.g., regular pay) may be designated for automatic assignment to new employees. When employees receive tips that are taxable, an automatic deduction feature allows tax calculation on earnings such as tips and then automatically deducts the tips from the total earnings before check printing. The Display additional options... button provides access for creating a Code Listing report.

=> To access this task...

Select Pay Codes from the Inquiry and Maintenance menu.

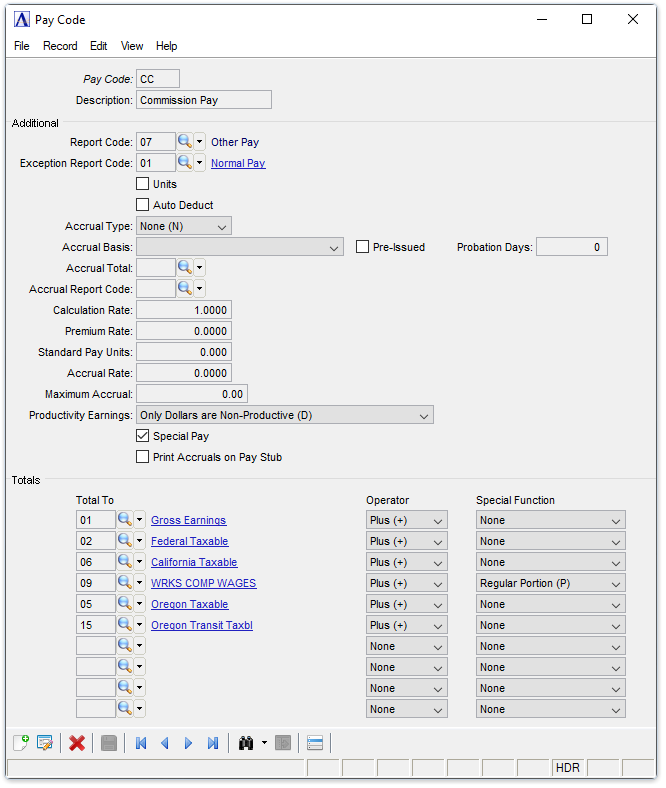

Pay Code maintenance

About the Fields

This screen is divided into two sections. The upper section contains information defining the pay code. The lower section contains information which determines how and where the pay amount will accumulate.

To Enable Edits to the form select  .

.

In the Pay Code field...

-

Enter a 2-character pay (Earnings) code

-

Click

to select from a list of all valid pay codes.

to select from a list of all valid pay codes. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

In the Description field...

This description will display when this code is entered to establish pay codes in the Employee Masterfile Maintenance task.

-

Enter a description of up to 16 characters to describe this pay code.

In the Report Code field...

-

Enter a valid report code.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

This code specifies the column in which earnings for this pay code are to be printed on the Payroll Earnings Register, Payroll Distribution Report, and Payroll Earnings History Report (Refer to Report Code maintenance).

In the Exception Report Code field...

This code specifies the column in which earnings for this pay code are to be printed on the Daily Processing Payroll Exception Report.

-

Enter a valid report code.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

Units checkbox...

A pay code such as Regular Pay in which the number of hours worked are multiplied by an hourly rate or the specified calculation rate would have this field checked.

-

Mark the box to multiply the units worked by the employee’s pay rate or by a calculation rate.

-

Unmark the box if the units will not be multiplied.

Auto Deduct checkbox...

-

Mark the box to establish a link to a corresponding deduction code.

-

Unmark the box if an automatic deduction does not apply.

An automatic deduction will reduce total earnings by the amount of this pay code after taxes are calculated. This feature may be used for employee tips or taxable meal allowances paid directly to the employee in cash and not included on this check. After taxes are calculated, the automatic deduction code causes the earnings to be deducted (or canceled) before checks are printed. To use this feature, the pay identification code and deduction identification code must be the same (e.g., a pay code of “TT” and a deduction code of “TT” for taxable tips).

From the Accrual Type dropdown...

Enter one of the following to specify how earnings for this pay code are to be accrued.

-

Select Fixed (F) if a fixed dollar amount is accrued for each pay period and is determined by the amount entered in the Accrual Rate field, described below, or by the Accrual Rate assigned in the individual Employee Masterfile (Refer to Employee maintenance).

-

Select Units (U) if the amount accrued depends on units of time worked by the employee.

-

Select Dollars (D) if the amount accrued depends on the dollar amount earned by the employee

-

Select None (N) if there is no accrual for this type of earning.

From the Accrual Basis dropdown...

This field is not accessible if None was entered in the Accrual Type field.

The Accrual Basis field controls when the accrual information contained in the employee’s pay code is reset (or rolled).

-

Select Employee's Anniversary (A) from the Accrual Basis list box to accrue based on the employee’s Anniversary date. The amounts in the employee’s pay code will be rolled based on the employee’s anniversary being reached when the P/R update is run during the normal pay cycle processing.

-

Select Calendar Year (C) from the Accrual Basis list box to accrue based on a Calendar year. The amounts in the employee’s pay code will be rolled when the P/R Year End Update is performed.

The reset process for both options is as follows:

-

Select Calendar Year (C) from the Accrual Basis list box to accrue based on a Calendar year.

-

Last Year is set to Last Year + This Year – Anniversary Used

-

This Year is set to Next Year

-

Next Year is set to zero

-

Anniversary Used is set to zero

Pre-Issued checkbox...

-

Mark the box if the employer has elected to use the Pre-Issued method for sick pay accruals.

In the Probation Days field...

This field is accessible if the Pre-Issued checkbox is marked and the field determines the number of days the employee must be employed before they start receiving the Pre-Issued sick leave hours as calculated against the hire date. The employee must have the Sick Pay Code defined in their Employee file, but with initial amounts of zero. After the probation period is reached, the employee will then be automatically issued the 24 hours of available sick leave.

If the employer has chosen the Pre-Issued method, then the calculation rate determines the total number of pre-issued hours, typically 24 hours.

If the employer has not chosen the Pre-Issued method, then the calculation rate is typically 0.0333 or 1-hour of sick leave for 30-hours worked.

In the Accrual Total field...

This field is accessible only if Units or Dollars were entered in the Accrual Type field.

-

Enter the total code that is the basis for the accrual calculation.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the Accrual Report Code field...

This code specifies the column in which accruals for this pay code are to be printed on the Daily Processing Payroll Accrual Report.

-

Enter a valid report code.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the Calculation Rate field...

-

Enter the calculation rate to be used if not based on an individual employee pay rate.

-

Or, enter 0 (zero) if the calculation is based on the individual employee pay rate.

In the Premium Rate field...

- Enter the factor by which the employee’s pay rate is multiplied to calculate earnings (e.g., 1.00 for regular pay, 1.50 for overtime, 2.00 for double time).

This factor is multiplied by the employee’s pay rate and that result is then multiplied by the units of time worked to produce the correct earnings

(e.g., 2.00 for double time times a regular pay rate of $8.00 per hour times 4.00 hours worked = $64.00 in earnings).

In the Standard Pay Units field...

-

Enter the standard number of units normally associated with this pay code, if applicable.

-

Or, enter 0 (zero) if a standard number of units does not apply to this pay code.

In the Accrual Rate field...

This field is not accessible if None was entered in the Accrual Type field.

-

Enter the accrual rate for this pay code.

-

Or, enter 0 (zero) if the accrual rate varies for individual employees or does not apply for this pay code.

Accrual Rate Example

If the Accrual Type is Fixed and 2.50 hours are accrued for each pay period (e.g., for vacation pay), 2.50 would be entered as the Accrual Rate.

In the Maximum Accrual field...

This field is used to determine the annual maximum amount available, typically 24-hours.

-

Enter the maximum accrual in hours.

From the Productivity Earnings dropdown...

Enter one of the following to specify which represents actual productivity earnings for this pay code, dollars, or units of work. This information is used to print the earnings reports. Productive types A and C will print both dollars and units on reports; types B and D will print only dollars.

-

Select Units and Dollars are Productive (A) if Both units of work and dollars represent productivity (e.g., regular pay).

-

Select Only Dollars are Productive (B) when Only dollars represent productivity (e.g., commission or bonus pay).

-

Select Units and Dollars ad Non-Productive (C) when Both units of work and dollars are non-productive (e.g., holiday pay, vacation pay).

-

Select Only Dollars are Non-Productive (D) when Only dollars are non-productive (e.g., employee training when hours are worked but are not yet productive).

Special Pay checkbox...

-

Mark the box when only certain employees will have earnings for this pay code.

-

Unmark the box if all employees will have earnings for this pay code.

Pay codes that are left unchecked in the Special Pay field are assigned to all new employees as they are defined in the Employee Masterfile (Refer to Employee maintenance).

Special Pay Example

Regular pay would generally be assigned to all employees, and the entry in this field would be left unchecked. For earnings such as profit sharing or bonus pay, the field would be checked since only a few employees would be receiving earnings in that pay code.

Print Accruals on Pay Stub checkbox...

Certain types of contributions may have reporting requirements notifying the employee of accruals made, along with year to date contributions such as California Accrued Sick Leave.

-

Mark the box when this accrual should be listed on the employee's paystub.

-

Unmark the box if it is not to be listed on the employee's paystub.

In the Total To fields...

Up to 10 Total To locations can be entered for each pay code.

-

Enter a valid total code into which this amount is accumulated during calculation of payroll taxes, contributions, and accruals.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

From the Operator dropdown...

-

Select Plus (+) when this contribution is to be added into the total specified above.

-

Select Minus (-) when the contribution is to be subtracted from the total specified above.

-

Select None when the contribution is to be neither added or subtracted from the total specified above.

When finished entering Pay Code Information...

-

Click

to save the record.

to save the record. -

Click

to clear the form and begin again.

to clear the form and begin again. -

Click

to delete the record selected.

to delete the record selected.

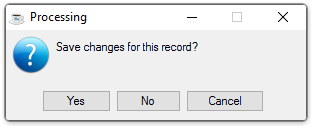

If the Window is closed without saving the record, the module issues this confirmation prompt:

-

Click [Yes] to save the changes.

-

Click [No] to return to the Payroll Maintenance Menu without saving the record.

-

Click [Cancel] to return to the Pay Code being edited.

Selecting the [Display additional options...] button  presents the option to create a listing of all Total Codes

presents the option to create a listing of all Total Codes

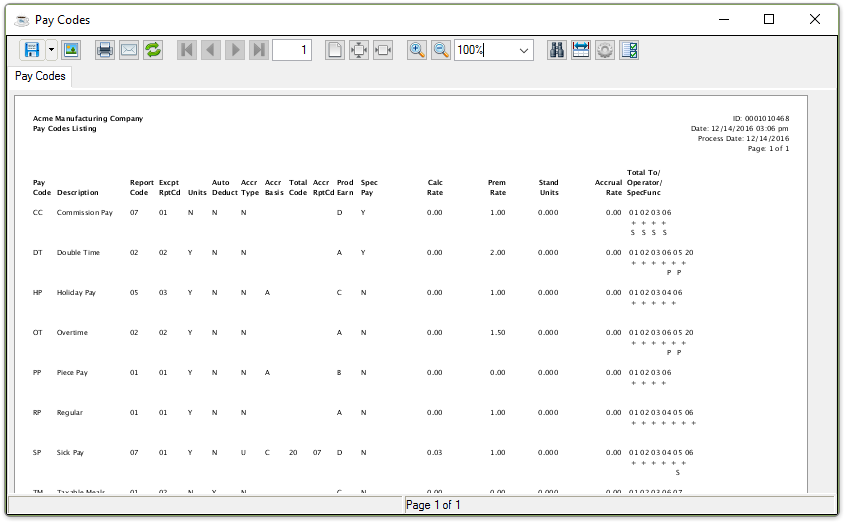

Selecting this option creates the report:

Sample Pay Code Listing

See Output Options

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.