Payroll - Detail Report

Function

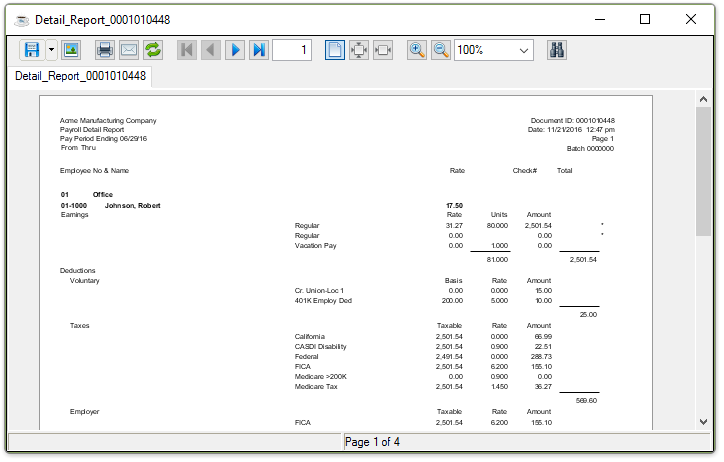

Prints all earnings, deduction, tax, contribution, and accrual information entered for each employee through the Payroll Entry task. Earnings are detailed by earnings code, pay rate, and units worked, and are totaled by hours and dollars. Deductions, employer taxes and employee accruals are detailed by type, with the basis, rate and total amount itemized for each. A net pay total reflects total earnings minus voluntary deductions and employee taxes withheld. Detail for manual check entries and reversals is included.

=> To access this task...

Select Detail Report from the Daily Processing menu.

If Batching has been enabled then you will be presented with the Process Batch Control Screen, to select an existing batch. Batching allows several people to work within the payroll system at the same time on a different set of processes. The Batch number assigned carries through the Daily Processing Menu Choices.

Process Batch Control

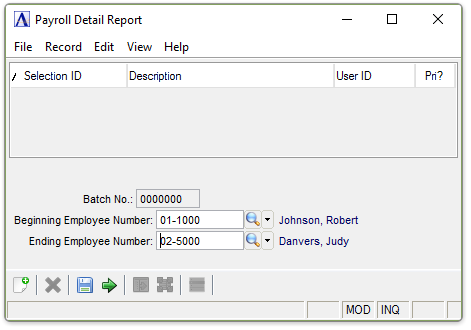

Payroll Detail Report

About the Fields

In the Beginning/Ending Employee Number field...

- Enter the first/last employee number to appear on the report.

- Click

to select from a list of valid codes.

to select from a list of valid codes. - Leave blank to indicate First/Last.

NOTE: Since no updating occurs when this report is printed, it is optional. However, the report must be printed before the Check Register update. The Check Register update process will clear the file that is used to print this report.

When done making selections...

- Click

to generate the Detail Report.

to generate the Detail Report.

Note: Exceptions will be noted both on the report and on the screen.

Sample Payroll Detail Report

See Output Options

When the process is complete, you are returned to the Payroll Daily Processing Menu.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.