Payroll - Deduction Status Report

Function

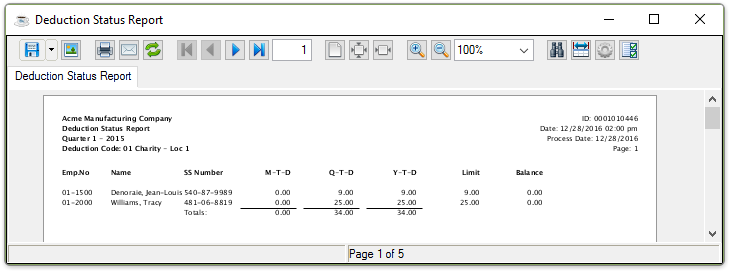

This task prints all deduction information by deduction code and employee. Month-to-date, quarter-to-date, and year-to-date totals are printed for each employee, followed by the deduction limit (if applicable) and the balance remaining to be deducted. Subtotals are printed by deduction code.

=> To access this task...

Select Deduction Status Report from the Periodic Processing menu.

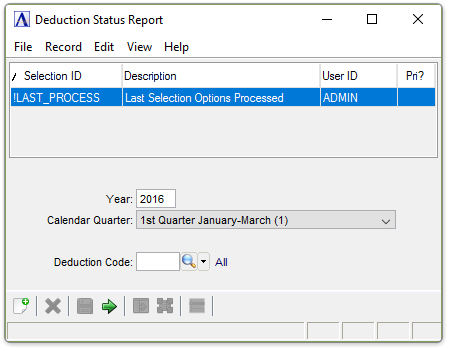

Deduction Status Report

About the Fields

In the Year field...

-

Enter the Calendar Tax Year that you would like reported.

From the Calendar Quarter dropdown...

-

Select 1st Quarter January-March (1) to print the first quarter on the report

-

Select 2nd Quarter April-June (2) to print the second quarter on the report

-

Select 3rd Quarter July-September (3) to print the third quarter on the report

-

Select 4th Quarter October-December (4) to print the fourth quarter on the report

The year-to-date figures are printed through the selected quarter.

In the Deduction Code field...

-

Enter a valid deduction code. Only deductions using this deduction code are printed.

-

Leave Blank to include all deduction codes in the report.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

When done making selections...

-

Click

to generate the Deductions Status Report.

to generate the Deductions Status Report.

Sample Deduction Status Report

See Output Options

When the process is complete, you are returned to the Payroll Periodic Processing Menu.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.