Payroll - Contribution Status Report

Function

This task prints employer tax information by contribution code and employee. Month-to-date, quarter-to-date, and year-to-date totals are printed for each employee; detailed by employee gross income, taxable income, and employer contribution tax amounts. Subtotals are printed by contribution code.

=> To access this task...

Select Contribution Status Report from the Periodic Processing menu.

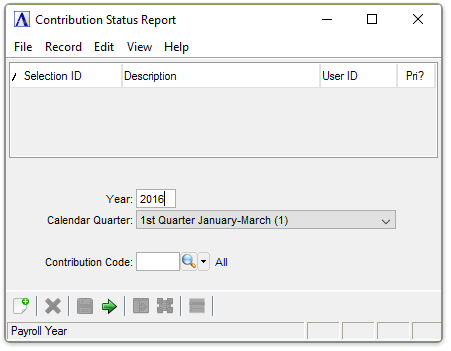

Contribution Status Report

About the Fields

In the Year field...

- Enter the Calendar Tax Year that you would like reported.

From the Calendar Quarter dropdown...

The year-to-date figures are printed through the selected quarter.

-

Select 1st Quarter January-March (1) to print the first quarter on the report.

-

Select 2nd Quarter April-June (2) to print the second quarter on the report.

-

Select 3rd Quarter July-September (3) to print the third quarter on the report.

-

Select 4th Quarter October-December (4) to print the fourth quarter on the report.

In the Contribution Code field...

-

Enter a valid contribution code. Only contributions using this contribution code are printed.

-

Leave Blank to include all contribution codes in the report.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

When done making selections...

-

Click

to generate the Contribution Status Report.

to generate the Contribution Status Report.

Sample Contribution Status Report

See Output Options

When the process is complete, you are returned to the Payroll Periodic Processing Menu.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.