General Ledger - Bank Reconciliation

Function

Use this task to add, delete, change, and inquire into checking account information. All information associated with the account is accessed through an option menu that displays when selecting an account. Bank Reconciliation features appear in two tabs: Bank Account Information and Statement Information.

To access this task...

Select Bank Reconciliation from the General Ledger menu.

Bank Account Information Tab

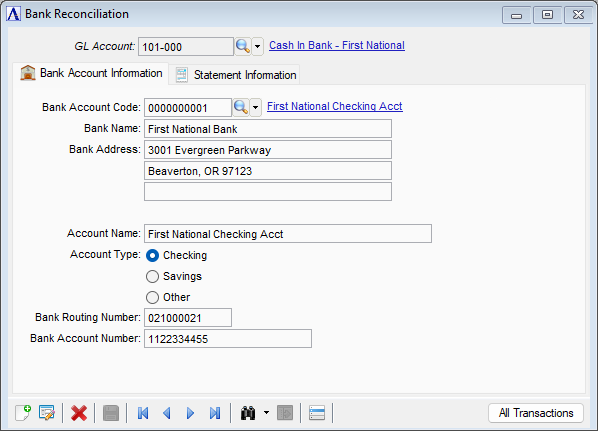

Bank Reconciliation - Bank Account Information tab

About the Fields

This screen is divided into two sections. In the upper section you enter the account number and a description of the account is displayed. When an existing account is entered, an option menu appears. The lower section is the workspace for information related to the option menu selection.

To enable edits to the form

select  .

.

In the GL Account field...

-

Enter the general ledger cash account number that identifies this checking account.

-

Click

to select from a list of

valid GL Accounts.

to select from a list of

valid GL Accounts. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

The general ledger description is displayed, along with a menu of options for performing reconciling the selected account.

About the Bank Reconciliation Options

The Bank Reconciliation drop down option menu allows the entry of varied information regarding an account without ever leaving the main task. By selecting available options from the option menu once an account is accessed, info can be viewed, edited or deleted or new data added.

Along with the account number and description, any information previously entered for an option is displayed in the working area of the screen. Prompts requiring attention and pertaining to the selected option’s fields, appear at the bottom of the screen.

In the Bank Account Code field...

Bank Account Codes are maintained in AddonSoftware Administration -> Settings -> Bank Account Codes task.

-

Click

to select a bank account code from

a list of active code records. See Query

Functions.

to select a bank account code from

a list of active code records. See Query

Functions. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

In the Bank Name field...

Display only. Displays the name of the banking institution.

In the Bank Address field...

Display only. Displays the bank's mailing address.

In the Account Name field...

Display only. Displays the description of the account.

In the Account Type selector...

Display only. Displays Checking, Savings, or Other.

In the Bank Routing Number field...

Display only. Displays the bank's routing number.

In the Bank Account Number field...

Display only. Displays the account number.

The All Transactions button...

-

Click All Transactions to launch both the Check Detail grid and Deposits/Other Transaction grid so both can be edited at the same time.

Additional Options...

Click  to reveal a dropdown of additional functions:

to reveal a dropdown of additional functions:

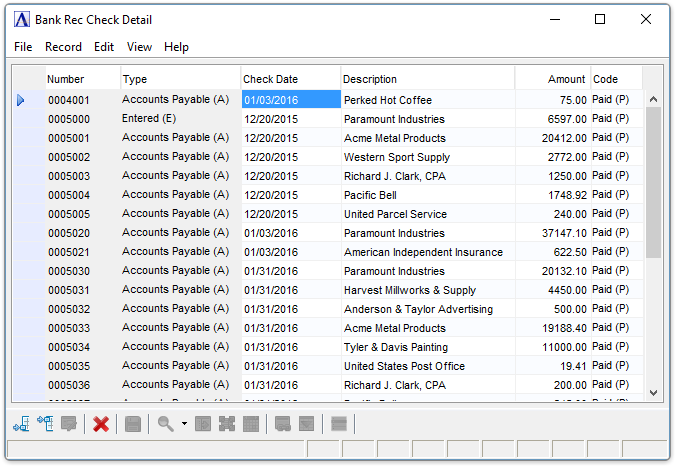

Bank Rec Check Detail

Use this option to review the list of checks that haven't been removed, and change the status of checks that have been paid by the bank. The Shift and Ctrl keys can be used to select multiple rows in the grids. A right-mouse click on the grid pops up a menu to allow selecting the "Code" for all the selected rows. Note that the "Codes" are different for the two grids.

Note:

Because you can opt not to remove paid transactions, the list may show paid as well as outstanding checks.

Sample Bank Rec Check Detail

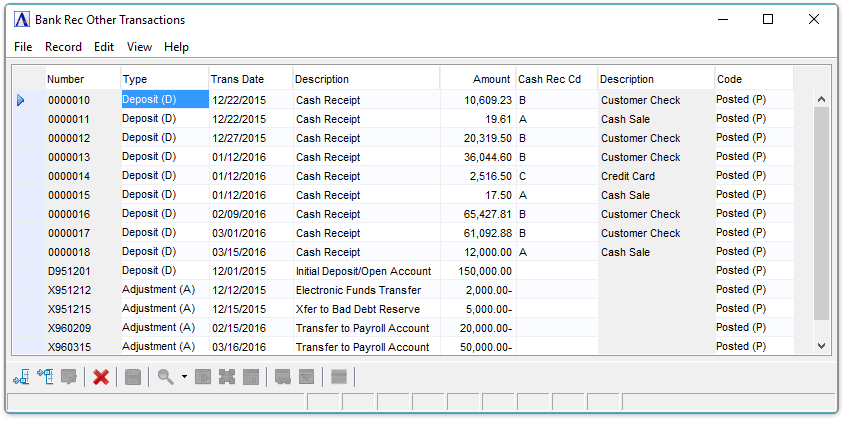

Bank Rec Other Transactions

Use this option to make additions, deletions, inquiries, payments and changes to information for bank account deposits, service charges, adjustments or other types of non-check transactions. You can also review and mark as "Posted" any transactions (other than checks) that have cleared the bank. The Shift and Ctrl keys can be used to select multiple rows in the grids. A right-mouse click on the grid pops up a menu to allow selecting the "Code" for all the selected rows. Note that the "Codes" are different for the two grids.

Sample Bank Rec Other Transactions

About the Fields

In the Number field...

-

The Number column is now only enabled for new rows. Deposits that are generated during Cash Receipts or Invoice Entry Cash Sales will carry the deposit number assigned when the deposit record was created.

-

Enter a number to identify the new transaction. For Deposit type transactions, if the number entered matches an existing Deposit record, it is rejected and you’re asked if you’d like a new deposit number.

In the Type field...

Select Deposit (D), Service Charge (S), or Adjustment (A) from the pull down.

In the Trans Date field...

Enter the transaction date.

In the Description field...

Enter a brief description for the transaction.

In the Amount field...

Enter the transaction amount.

In the Cash Rec Code field...

-

The Cash Rec Cd column is only enabled for Deposit type transactions.

-

Enter the code, or Ctrl + F to select from a query of existing codes.

In the Description field...

This field is display only, and contains the description for the selected Cash Rec Cd.

In the Code field...

Select Outstanding (O) or Posted (P) from the pull down.

Recalculate

Use this option to recalculate the Book Balance for the GL Account.

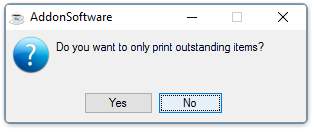

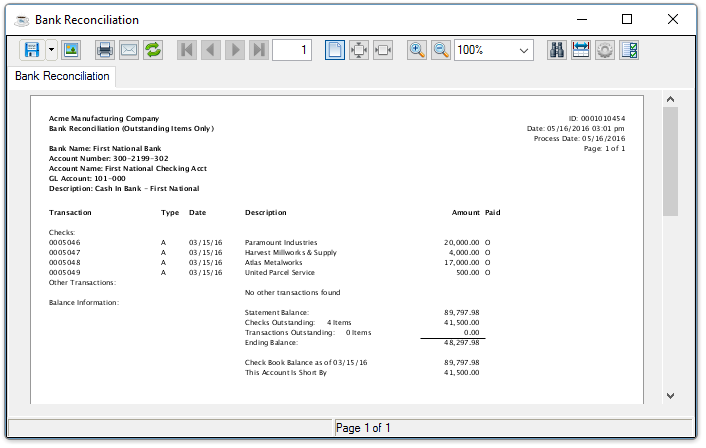

Detail List

Use this

option to generate a list of check and other transactions. It is recommended

that you print a final version of this report for future reference after

the account is balanced. Selecting this option gives the following prompt:

Do you want to only print outstanding items?

The Detail List shows Check transactions first, followed by Other transactions (Deposits, Service Charges, Adjustments). For Deposit type transactions, the corresponding Cash Rec Cd appears in parentheses at the end of the Description.

Detail Listing, Checks section

See Output Options.

Post

This option reconciles the general ledger account to the corresponding bank account using the entered and calculated data from the Statement Information tab. A calculation is performed to determine whether the bank statement is in balance with the corresponding general ledger account.

CAUTION:

Be sure to print a Detail Listing of all transactions before posting. Once paid transactions are removed it is not possible to recover them except from a backup, if available.

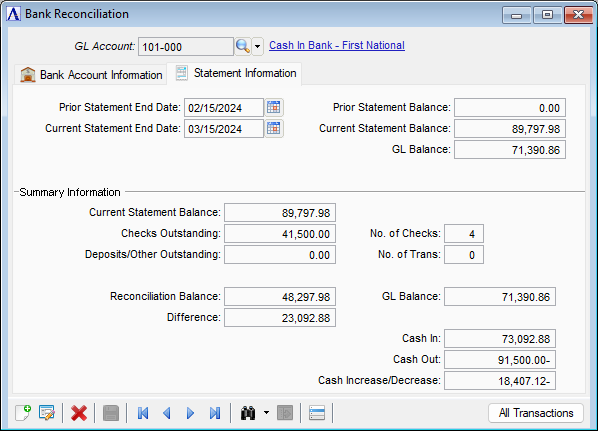

Statement Information Tab

Select the Statement Information tab for a recap of bank activity for the selected GL Account.

Bank Reconciliation - Statement Information tab

About the Fields

To enable edits to the form select  .

.

In the Prior Statement End Date field...

Display only. Shows the ending date of the prior bank statement. This date is updated using the Current Statement End Date field each time the account is indicated as “balanced.”

In the Prior Statement Balance field...

Display only. Shows the ending balance of the prior statement. This amount is updated using the Current Statement Balance field each time the account is indicated as “balanced.”

In the Current Statement End Date field...

Enter the ending date from the current bank statement. Click  to select a date by using the calendar tool.

to select a date by using the calendar tool.

In the Current Statement Balance field...

Enter the ending/closing balance from the current bank statement.

In the GL Balance field...

Display only. The balance of the GL Account as of the Current Statement End Date. This value is calculated using the Recalculate item in the Additional Options menu.

Summary Information

In the Current Statement Balance field...

Display only. Repeats the Current Statement Balance from above.

In the Checks Outstanding/No. of Checks fields...

Display only. Amount and number of checks with an Outstanding status. The list of checks is available via the Check Detail item in the Additional Options menu.

In the Deposits/Other Outstanding/No. of Trans fields...

Display only. Amount and number of other transactions with an Outstanding status. The list of other transactions is available via the Deposits/Other Transactions item in the Additional Options menu.

In the Reconciliation Balance field...

Display only. This amount should match the GL Balance above: Current Statement Balance - Checks Outstanding + Deposits/Other Outstanding = Reconciliation Balance.

In the Difference field...

Display only. The difference between the GL Balance and the Reconciliation Balance.

In the GL Balance field...

Display only. Repeats the GL Balance from above.

In the Cash In field...

Display only. Shows the amount of debits to the GL account during the statement period.

In the Cash Out field...

Display only. Shows the amount of credits to the GL account during the statement period.

In the Cash Increase/Decrease field...

Display only. Shows the net increase/decrease of debits - credits for the statement period.

When finished making entries to the fields...

-

Select

to save changes.

to save changes.

-

Select

to clear the form and begin again.

to clear the form and begin again.

-

Select

to delete the record.

to delete the record.