Payroll - Union Code

Function

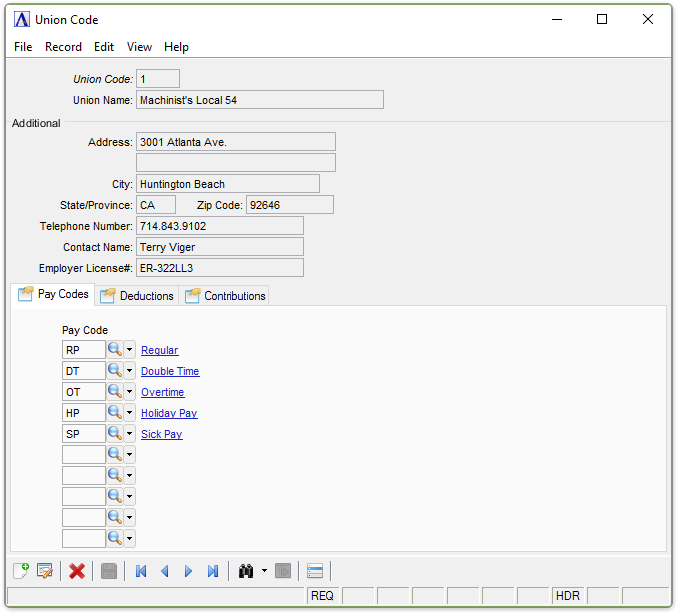

The Union Code maintenance task defines and maintains union codes and related information for reporting earnings, deductions, and employer contributions to employee unions. Based on the codes specified for each union, payroll accumulates and preserves information during the Payroll Update process. The form has three tabs - Pay Codes, Deductions, and Contributions. The Display additional options... button provides additional features.

=> To access this task...

Select Union Code from the Inquiry and Maintenance menu.

Union Code maintenance

About the Fields

The Union Code Maintenance screen is divided into two sections. The upper section (header) fields display the union code and the description of that code. The lower section is used to enter and display items from the option tabs

To Enable Edits to the form select  .

.

In the Union Code field...

-

Enter a code of up to 3 characters which identifies the union.

-

Click

to select from a list of all valid total codes.

to select from a list of all valid total codes. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

In the Union Name field...

This name is printed on the Union History Report.

-

Enter a name for the union represented by this code.

In the Address field...

This address is printed on the Union History Report.

-

Enter an address of up to two lines of 24 characters each.

In the City field...

This city is printed on the Union History Report.

-

Enter the City of up to 20 characters.

In the State/Province field...

This State is printed on the Union History Report.

-

Enter the State/Province Abbreviation, up to 2 characters.

In the Zip Code field...

-

Enter a 5 to 9 digit zip code (depending on the zip code parameter set in the System Parameters option of the Parameter Maintenance task).

In the Telephone Number field...

-

Enter a 10-digit telephone number for the union (area code first).

In the Contact Name field...

-

Enter a name up to 20 characters in length of an individual to contact at the union.

In the Employer License # field...

-

Enter the employer license number assigned to the company by the union. This number may be up to 20 characters.

Pay Codes Tab

Function

Pay Code Assignments

Up to ten different pay codes can be assigned to each union code. These pay codes may then be used by any employee who is a member of the union associated with the code. The accumulated earning information is printed on the Union History Report for all employees working with these pay codes.

Union Code - Pay Codes tab

In the Pay Code fields...

The Pay Code Information is compiled and printed on the Union Reports.

-

Enter a valid pay code.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

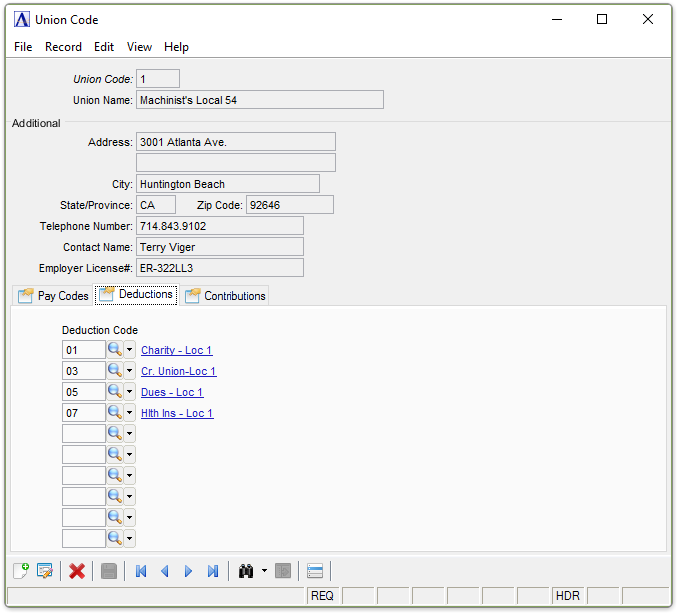

Deductions Tab

Function

Up to ten different deduction codes can be assigned to each union code. These deduction codes may then be used by any employee who is a member of the union associated with the code. The accumulated deduction information is printed on the Union History Report for all employees working with these deduction codes.

Union Code - Deductions tab

In the Deduction Code fields...

The Deduction Code Information is compiled and printed on the Union Reports.

-

Enter a valid deduction code.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

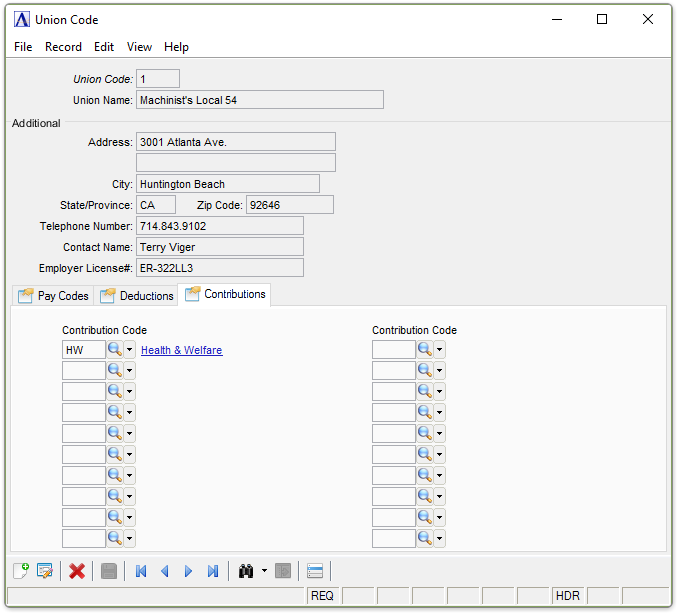

Contributions Tab

Function

Up to twenty different contribution codes can be assigned to each union code. These contribution codes may then be used by any employee who is a member of the union associated with the code. These codes should include all employer-paid taxes, workers compensation, medical and dental insurance, profit sharing and any other employer-paid taxes or fringe benefits paid to employees of the company, as well as any benefits that are employer/employee matched (e.g., profit sharing) or co-payments made by both the company and the employee union (e.g., insurance, profit sharing, retirement plans, etc.).

Union Code - Contributions tab

In the Contribution Code fields...

The Contribution Code Information is Compiled and Printed on the Union Reports

-

Enter a valid contribution code.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

When finished entering Union Code Information...

-

Click

to save the record.

to save the record. -

Click

to clear the form and begin again.

to clear the form and begin again. -

Click

to delete the record selected.

to delete the record selected.

If the Window is closed without saving the record, the module issues this confirmation prompt:

-

Click [Yes] to save the changes.

-

Click [No] to return to the Payroll Maintenance Menu without saving the record.

-

Click [Cancel] to return to the Union Code being edited.

Selecting the Display additional options... button  presents the option to create a listing of all Union Codes

presents the option to create a listing of all Union Codes

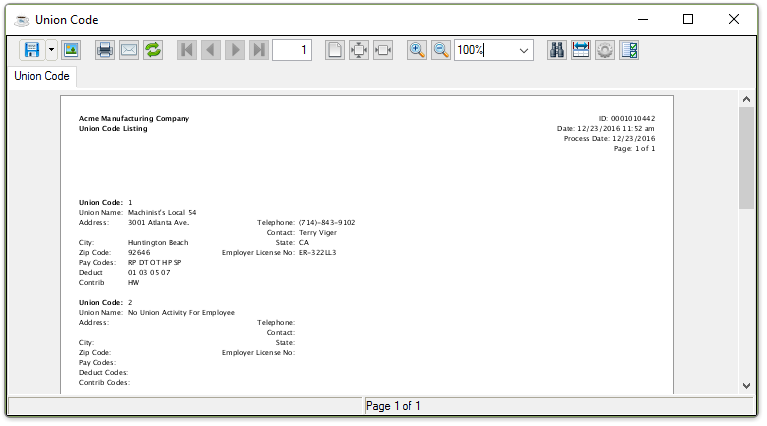

Selecting this option creates the report:

Sample Union Code Listing

See Output Options

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.