Payroll - Tax Tables

Function

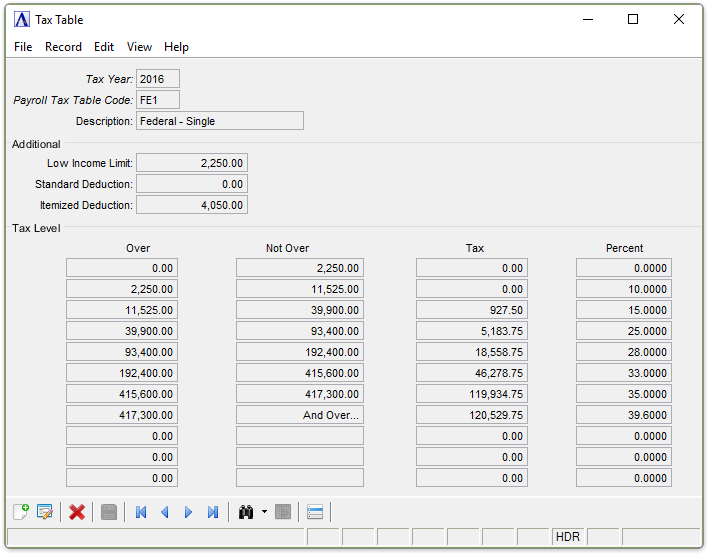

The Tax Tables maintenance task allows the definition and maintenance of federal, state, and local tax tables used in the automatic calculation of employee taxes. A listing of all tax codes can be printed before leaving the task. The Display additional options... button provides access for creating a Code Listing report.

NOTE: It is not necessary to define resident Federal tax tables that applied up to the release of AddonSoftware 6.0. Be certain to print this table, however, and compare it with the most recent Circular E Tax Guide to ensure that all calculation information is accurate. Tax tables for subsequent years must be entered each year. State tax tables may be provided by your AddonSoftware dealer, but they should also be printed and compared with the most recent tax guide to ensure that all the necessary information is complete and accurate.

=> To access this task...

Select Tax Tables from the Inquiry and Maintenance menu.

Tax Tables

About the Fields

Only Annual Tables using the Percentage Method of Withholding Based on Annual Pay should be entered for any table. No default tables are required for state and local taxes that do not use a table. Refer to the most recent Circular E Employer’s Tax Guide to calculate the correct Federal information, and use the applicable State and Local Tax Guides for entering the correct State and Local tax information.

The screen is divided into two sections. The fields in the upper section identify the Table ID. The fields in the lower section identify the tax brackets within that Table ID. Up to eleven tax brackets may be created.

To Enable Edits to the form select  .

.

In the Tax Year field...

-

Enter the Calendar Tax Year that this Tax Code Applies to.

-

Click

to select from a list of all valid tax table codes.

to select from a list of all valid tax table codes. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

In the Payroll Tax Table Code field...

-

Enter a 3-character tax code (e.g., FE1 for Federal Income Tax Single).

-

The first two characters of the table ID are comprised of the 2-character tax code associated with this table. The third character shows the filing category.

Table ID Example

When defining Federal tax tables, tax code FE becomes the first two characters in the tax table ID code for each federal tax table to be established

(e.g., FE1 is the Federal tax table ID code for single individuals and FE2 for married individuals).

When the tax code exists, the current information is displayed.

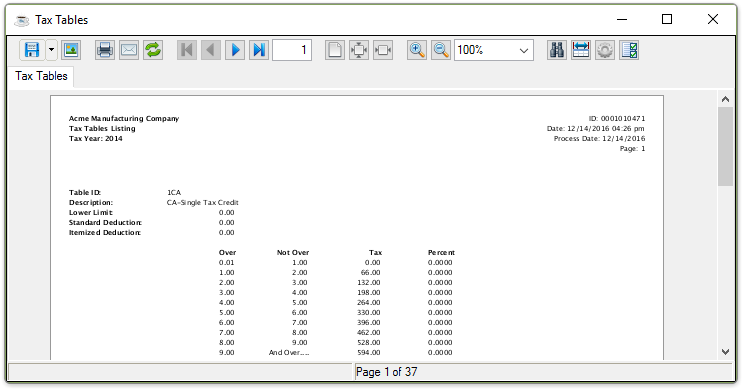

NOTE: In some states, a tax credit may be applied to specific tax tables. For such instances, define a tax table ID code that corresponds

to the regular tax table ID, but with the arrangement of the ID characters reversed (e.g., to establish a Tax Credit Table for CA1 State tax table for single individuals, define a tax table ID code of 1CA). When calculating taxes on which a tax credit applies, the tax is calculated first based on the regular tax table, then any credit amount calculated from the Tax Credit Table is deducted.

In the Description field...

-

Enter a maximum of 20 characters to describe the tax table (e.g., Fed ‑ Single, Fed ‑ Married, etc.).

In the Low Income Limit field...

For employees with year-to-date earnings less than this amount, no tax is calculated and withheld from earnings.

-

Enter the lower limit of this tax, as specified in the Federal, State or Local Tax Guide.

In the Standard Deduction field...

This amount is multiplied by the number of withholding allowances selected in the Tax Code Maintenance option of the Employee Masterfile Maintenance task. When D is among the codes in the calculation sequence, this standard deduction is used in the calculation of state taxes as dependent deduction.

-

Enter the standard deduction amount by which an employee’s taxable earnings are reduced for each withholding allowance.

In the Itemized Deduction field...

This amount is multiplied by the number of withholding allowances selected in the Tax Code Maintenance option of the Employee Masterfile Maintenance task. This deduction may also be used for additional state deduction allowances.

-

Enter the itemized deduction amount by which employee taxable earnings are reduced for each Federal withholding allowance.

In the Over field...

-

Enter the lower income bracket for each tax table line, as listed in the Federal, State, or Local Tax Guide.

In the Not Over field...

-

Display only. The module automatically calculates the amount after you end the tax bracket entry.

In the Tax field...

-

Enter the dollar amount of tax to be withheld for the income level (Over, Not Over) for each tax table line, as listed in the Federal, State, or Local Tax Guide.

In the Percent field...

-

Enter the additional percentage of earnings to be withheld when income exceeds the lower income bracket for each tax table line, as listed in the Federal, State, or Local Tax Guide. Enter percentages as whole numbers (e. g., enter 10% as 10, not .10).

When finished entering Tax Table Information...

-

Click

to save the record.

to save the record. -

Click

to clear the form and begin again.

to clear the form and begin again. -

Click

to delete the record selected.

to delete the record selected.

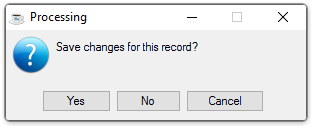

If the Window is closed without saving the record, the module issues this confirmation prompt:

-

Click [Yes] to save the changes.

-

Click [No] to return to the Payroll Maintenance Menu without saving the record.

-

Click [Cancel] to return to the Tax Table being edited.

Selecting the [Display additional options...] button  presents the option to create a listing of all Deduction Codes

presents the option to create a listing of all Deduction Codes

Selecting this option creates the report:

Sample Tax Table Listing

See Output Options

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.