Payroll Introduction

Overview

Thank you for selecting the AddonSoftware Payroll module. This manual will introduce you to the capabilities of the software, help you install and operate the software with the guidance of your dealer, provide complete processing instructions, and serve as a reference guide for all menu tasks and data entry fields. The manual is divided into five main sections.

Introduction

This section contains an overview of the Payroll module features, a list of standard reports and registers, and a flow chart of system processing. A software registration card is also included to fill out and return directly to AddonSoftware.

Flow of Processing

This section consists of step-by-step procedures for daily, monthly, and quarterly processing within the module. A processing checklist is also provided for frequent reference when operating the Payroll module. Month-end and year-end lists are also available on the web site www.addonsoftware.com. Contact your dealer for more information.

Operations

This section is comprised of instructions for operating each Payroll task. Each menu task is explained in the order in which it appears on the standard software, with descriptions of each field and operator prompt.

Appendixes

The appendixes in the Payroll manual display sample copies of the reports and registers generated by the module, provide additional information regarding special payroll entries such as bonuses or vacation checks, offer a broader explanation of payroll codes, and show how to enter taxable tip income, etc.

The AddonSoftware Payroll module greatly simplifies the task of payroll processing, ensuring accurate earning, deduction, tax, and accrual calculations, and providing comprehensive report and inquiry features.

Throughout this manual, it is assumed the reader has a working knowledge of accounting or will have the advice of an accounting professional for the installation and operation of the Payroll module. It is very important that each of the installation steps be implemented carefully and thoroughly so that the Payroll module produces the expected results and posts correctly to the General Ledger module (if installed).

Required and Optional Application Modules

The AddonSoftware Administrator module provides a listing of the systems that must be in place to operate each new AddonSoftware software module. The AddonSoftware Administrator module is provided for easy referencing with your first-time purchase of any AddonSoftware.

If the AddonSoftware Shop Floor Control and General Ledger modules are installed, they may be integrated with the AddonSoftware Payroll module. Whenever several different AddonSoftware modules are to be used, your dealer will help determine the best installation sequence.

Features and Benefits

The following is a list of standard payroll features and a description of their function within the Payroll module:

User-Defined Pay and Deduction Codes

As many different types of earning and deduction codes as needed may be defined. Standard codes applicable to all employees may be designated for automatic assignment when adding a new employee to the payroll.

Flexible Employee Numbers

Employee numbers are variable from 1 to 9 alpha-numeric digits and may be segmented as needed to designate divisions, departments, etc.

User-Defined Taxes and Contributions

Employee tax codes, employer tax codes, employer union contributions, and others may be created in response to changes in federal, state, or local regulations.

Sick and Vacation Accrual

Any type of earnings may be used as a basis to accrue sick leave, vacation, or other compensatory time or dollar earnings. Simply designate the basis to be used when establishing the earning codes. Time or dollars are automatically accrued each specified pay period.

Multi-State Taxes

Each employee may have taxes and employer contributions for multiple states, counties, and/or cities. Multiple states may be processed in the same payroll run.

Simple Tax Tables

Tax tables are entered just as they appear in government publications. Since the Payroll module uses the “Exact Calculation Method”, only an annual table needs be entered for each tax category.

Flexible Report Formats

Earning, deduction, tax, and contribution reports may be formatted for specific needs. Report headings may be customized to reflect industry-specific terminology or special categories.

Personnel Information

Emergency contact information; hire, review, anniversary, and termination dates; pension participation and other key personnel information is stored for each employee. The information may be printed on a report or viewed on the screen in the Employee Masterfile Maintenance task.

Multiple Job Titles/Pay Rates

Each employee may be assigned pay rates for up to five different job titles. This allows processing of an employee who may routinely work under different titles during one pay period. Earnings are calculated based on the specific rates for each job title and can be combined into one earnings line on the employee’s paycheck.

Pay Change History

A history of the last five pay rate changes, and increase or decrease in the number of hours worked, may be kept for each employee.

Status Inquiry

Inquiry into the status of each pay type, deduction type, tax, or employer contribution for an employee may be done. Information is retained on a monthly, quarterly, and year-to-date basis.

Summarized Check Inquiry

All checks issued to an employee for the current year may be displayed. The inquiry display includes all computer checks, manual checks, and reversed checks issued to date. Earnings, deductions, taxes, and net check amount are displayed in the same summarized format as the Payroll Check Register.

Employee Termination/Reactivation

Employees may be terminated or reactivated at any time. Protection devices automatically ensure that terminated employees cannot be issued a paycheck and that all employee information is retained until year-end for tax reporting purposes.

Employee Number Change

An employee number may be changed (e.g. for an employee who has transferred to a different department) prior to entering information for the current payroll period. All related payroll history information for the employee will be automatically changed. New entries will be posted to the correct general ledger accounts for the new department.

Automatic Pay/Deductions

Earnings and deductions for salaried and hourly employees working a standard number of hours per pay period may be automatically generated each payroll period. This feature results in a substantial savings of entry time and may eliminate data entry requirements for these employees other than the exceptional situation.

Multiple Checks Per Employee

From 1 to 99 separate checks may be issued per employee per pay period. This feature is useful when issuing a regular, vacation, bonus, or commission check to the same employee during the same pay period.

Manual Check and Check Reversal Multiple Checks Per Employee

Manual (handwritten) checks may be recorded or reversal of a computer/manual check may be entered. When recording manual checks that have not yet been written and distributed, the automatic earnings and tax calculation features of the system may be used to assist with check preparation.

Labor Distribution

All earnings are distributed by department and job title. A labor distribution report may be printed itemizing labor expense by department and title prior to printing checks. A monthly, quarterly, and yearly history is available.

Automatic Calculation

Based on earnings entered and voluntary deductions defined, all taxes, employer contributions, and accruals are automatically calculated for each employee. All tax, contribution, or accrual figures may be overridden after the calculation is complete.

Pre-Check Report

In addition to other payroll audit reports, a report showing the earnings, deductions, and net pay for each employee may be printed prior to printing checks. This allows a last-minute look at the figures that will be printed on employee checks.

Check Printing

The module produces printed checks for all active employees within the specified pay period. Detailed earnings, deductions, and taxes for the current period and year-to-date are printed on the check stub. In the event of a paper jam or printer malfunction, reprinting may begin with a specific employee number.

Government Reporting

Reports are available for earnings, deductions, taxes, employer contributions, accruals, and other employee status information. W-2 information may be printed, on demand, at any time throughout the year.

Departmental Reporting

By using the appropriate department number as part of each employee number, payroll information by department may be captured as each payroll is processed. This allows printing of a wide variety of reports, sub-totaled by department.

Union Reporting

Any number of union codes and related information may be established for reporting earnings, deductions, and employer contributions to employee unions. This allows printing of a monthly union report detailing weekly employee earnings, hours worked, deductions, taxes, and employer contributions, as well as the percentages used for calculations.

Multi-Company Capability

This allows processing for more than one company, each with its own separate set of payroll parameters, employees, period processing, and reporting.

Reports and Registers

The Payroll module also includes a full range of reports and registers, providing up-to-date information concerning the status of each employee’s earnings, deductions, taxes, accruals, employer contributions, and data recently entered. The standard reports and registers are:

• Employee Masterfile Listing • Payroll Check Register

• Employee Master List • Payroll Daily Entry Register

• Employee Cross Reference Report • Payroll Distribution Report

• Payroll Earnings Entry Report • Payroll Distribution History Report

• Payroll Earnings Register • Payroll G/L Distribution Report

• Payroll Deduction Report • Earnings Status Report

• Employee Labels • Earnings History Report

• Payroll Tax Report • Deduction Status Report

• Payroll Contribution Report • Tax Status Report

• Payroll Accrual Report • Contribution Status Report

• Payroll Exception Report • Accrual Status Report

• Payroll Detail Report • Payroll Check History Report

• Monthly Check Report • Union History Report

• Payroll Pre-Check Report • Payroll Date List

• Payroll Check Printing • W-2 Printing

• Magnetic Media Audit Report • W-2 Configuration Hard Copy

Each register and report is described in more detail in the Operations section of this manual and sample copies are shown in Appendix A. In addition to the standard features, your dealer can customize the software to tailor reports to your exact needs.

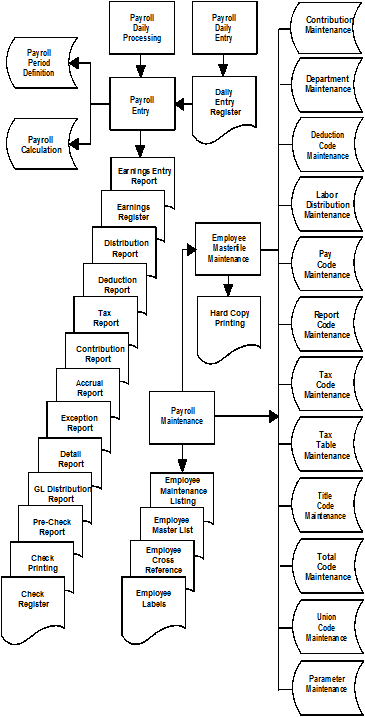

Payroll System Flow

This chart shows the flow of data through the AddonSoftware Payroll module. A detailed description of how the system operates is provided in the Flow of Processing section and the Operations section of this manual.

Payroll System Flow, continued

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.