Payroll - Create Pay/Deduct/Tax/Contrib Codes

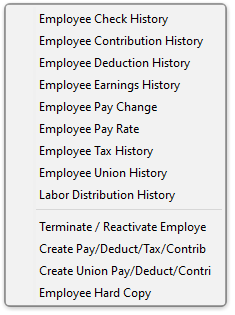

This task is accessed from the Display additional options button  on the Employee maintenance form.

on the Employee maintenance form.

Function

When adding new employees to the Employee Masterfile, all non-special pay, deduction, tax, and contribution codes are assigned to each employee record by choosing this option. Non-special codes are codes where the Special Field Check Box was left unmarked in the appropriate code maintenance tasks.

This option can also be used to automatically assign non-special pay codes, deduction codes, tax codes, and contribution codes to an established employee record, when entering a new deduction such as medical or dental insurance, an increase in union dues, or a new tax affecting all employees.

Creation of standard pay codes, deduction codes, tax codes, and contribution codes begins automatically when selected from the option menu. Each code is compared to the codes in the employee’s record, and any non-special codes encountered that do not already exist in the employee record are automatically assigned, based upon the Current Payroll Year.

The Progress Bar indicates processing status.

NOTE: All “special” codes must be assigned specifically to each employee to whom the code applies. This prevents erroneous payments or deductions to employees.

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.