General Ledger - Year End Update

Function

During the Year End Update, current year actual and budget figures for each general ledger account are moved to the prior year history file; next year actual and budget figures are moved to current year. Income and expense account balances will be accumulated, and the difference between income and expense will be posted to the retained earnings account specified in the parameters. The ending balances for Asset, Liability, and Capital accounts will become beginning balances for the new year. Income and expense account balances will be set to zero. The Year End Update Register is produced automatically.

=> To access this task...

Select Year End Update from the Period End Processing menu.

NOTE: The period-end process for the last fiscal period of the year should be completed first for all subsidiary accounting modules before closing the year for the general ledger. If Payroll is installed, it has a separate year-end update task to be performed after the last payroll of the fiscal year.

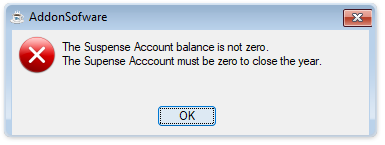

If the Suspense account is in use and has a non-zero balance, the following error will appear.

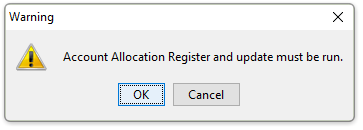

If you have not run the Account Allocation Register and have not updated it, the module issues this prompt:

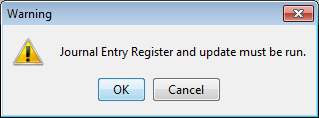

If you have not run the Journal entry form successfully and have not updated it, the module issues this prompt:

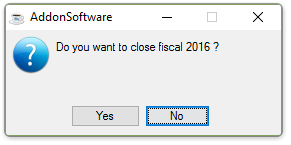

If all of the registers have been correctly run and updated, the system issues the following prompt:

-

Select [Yes] to proceed to close the fiscal year.

-

Select [No] to exit out of the process.

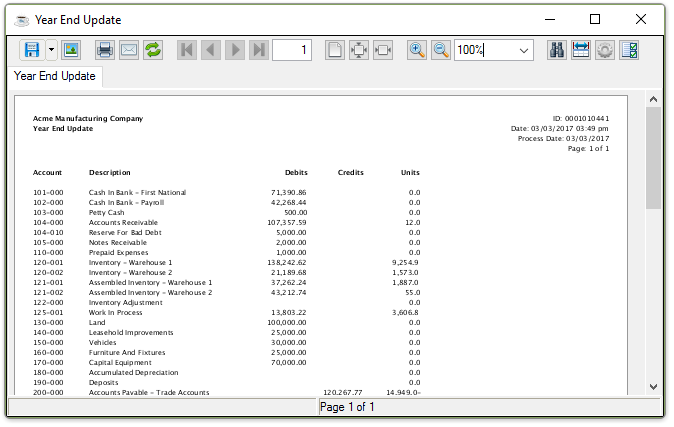

Sample Year End Update report

______________________________________________________________________________________

Copyright BASIS International Ltd. AddonSoftware® and Barista® Application Framework are registered trademarks.