Payroll - W-2 Box Definition

Function

The W-2 Configuration task is used to set up the W-2 print format and define the W-2 calculations required for each field. This task makes it possible to accommodate virtually any requirements for the IRS (SSA) standard W-2 form. Complete the information for each box on the W-2 form as instructed below. The Display additional options... button provides access for creating a Code Listing report.

To access this task...

Select W-2 Processing from the Periodic Processing menu, then select W2 Box Definition.

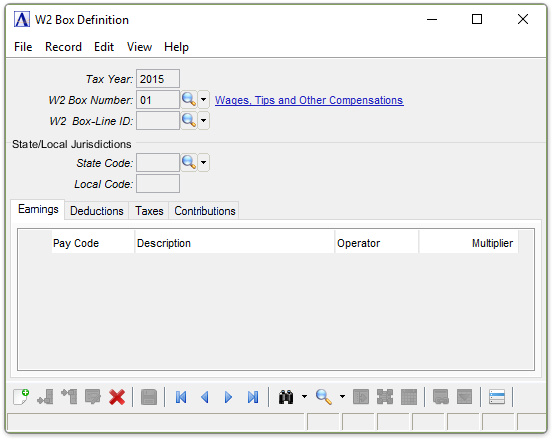

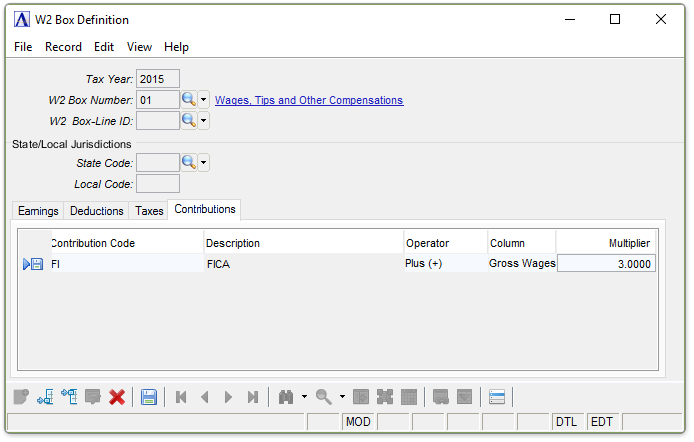

W2 Box Definition

About the Fields

To Enable Edits to the form select  .

.

In the Tax Year field...

-

Enter the Calendar Tax Year that this Code Definition Applies to.

-

Click

to select from a list of all valid codes.

to select from a list of all valid codes. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

In the W2 Box Number field...

-

Enter the number or letter of the box on the W-2 form. A description of the pay code appears in the next column

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the W2 Box-Line ID field...

-

Enter the number or letter of the box line on the W-2 form. A description of the pay code appears in the next column

-

Leave blank if the box does not contain sub-boxes or sub-lines.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the State Code field...

-

Enter a state code if applicable. A description of the pay code appears in the next column

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

In the Local Code field...

-

Enter a local code if applicable.

Note:

Refer to Appendix H regarding multiple state tax withholding. Review sample configuration for boxes 16 and 17. Boxes a through f and 15, 16, 19 are informational only. The calculation information described below is not required for these boxes.

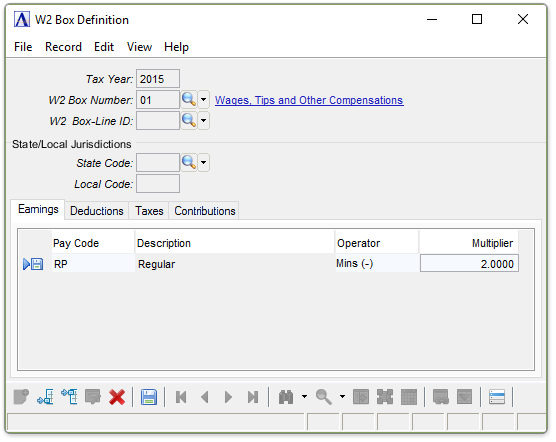

W2 Box Definition - Earnings tab

In the Pay Code column...

Earnings Code, may be displayed as Pay Code on some modules.

-

Enter a valid pay code. A description of the pay code appears in the next column.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

From the Operator dropdown...

-

Select the Plus Sign (+) if the amount in the Employee's Pay Code (Earnings History) Year to Date Dollars is to be added to the amount being calculated.

-

Select the Minus Sign (-) if the amount in the Employee's Pay Code (Earnings History) Year to Date Dollars is to be subtracted from the amount being calculated.

-

Select the None if the amount is to be ignored.

In the Multiplier field...

-

Enter a factor by which the amount in the designated code (and column) is to be multiplied for use in the calculation.

-

Enter 1 if no factor is to be used.

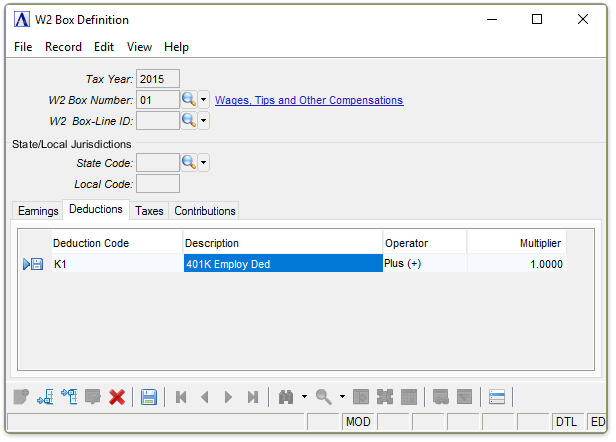

W2 Box Definition - Deductions tab

In the Deduction Code field...

-

Enter a valid deduction code. A description of the deduction code appears in the next column.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

From the Operator dropdown...

-

Select the Plus Sign (+) if the amount in the Employee's Deduction History Year to Date Dollars is to be added to the amount being calculated.

-

Select the Minus Sign (-) if the amount in the Employee's Deduction History Year to Date Dollars is to be subtracted from the amount being calculated.

-

Select the None if the amount is to be ignored.

In the Multiplier field...

-

Enter a factor by which the amount in the designated code (and column) is to be multiplied for use in the calculation.

-

Enter 1 if no factor is to be used.

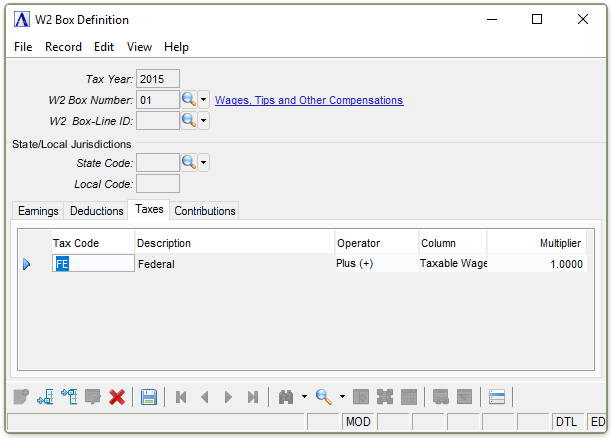

W2 Box Definition - Taxes tab

In the Tax Code column...

-

Enter a valid tax code. A description of the tax code appears in the next column.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

From the Operator dropdown...

-

Select the Plus Sign (+) if the amount in the Employee's Tax History - Year to Date Column is to be added to the amount being calculated.

-

Select the Minus Sign (-) if the amount in the Employee's Tax History - Year to Date Column is to be subtracted from the amount being calculated.

-

Select the None if the amount is to be ignored.

From the Column dropdown...

-

Select which Column of the Employee's Tax History is to be used.

-

Select Gross Wages to use the Gross Wages Column for the Calculation.

-

Select Taxable Wages to use the Taxable Wages Column for the Calculation.

-

Select Tax Amount to use the Tax Amount Column for the Calculation.

In the Multiplier field...

-

Enter a factor by which the amount in the designated code (and column) is to be multiplied for use in the calculation.

-

Enter 1 if no factor is to be used.

W2 Box Definition - Contributions tab

In the Contribution Code column...

-

Enter a valid Contribution code .A description of the contribution code appears in the next column.

-

Click

to select from a list of valid codes.

to select from a list of valid codes.

From the Operator dropdown...

-

Select the Plus Sign (+) if the amount in the Employee's Contribution History - Year to Date Column is to be added to the amount being calculated.

-

Select the Minus Sign (-) if the amount in the Employee's Contribution History - Year to Date Column is to be subtracted from the amount being calculated.

-

Select the None if the amount is to be ignored.

From the Column dropdown...

-

Select which Column of the Employee's Contribution History is to be used.

-

Select Gross Wages to use the Gross Wages Column for the Calculation.

-

Select Basis to use the Basis Wages Column for the Calculation.

-

Select Contribution Amount to use the Contribution Amount Column for the Calculation.

In the Multiplier field...

-

Enter a factor by which the amount in the designated code (and column) is to be multiplied for use in the calculation.

-

Enter 1 if no factor is to be used.

When finished making selections...

-

Click

to save the record.

to save the record. -

Click

to clear the form and begin again.

to clear the form and begin again. -

Click

to delete the record selected.

to delete the record selected.

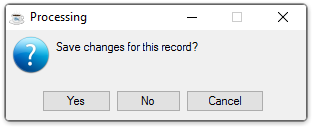

If the Window is closed without saving the record, the module issues this confirmation prompt:

Save changes for this record?

-

Click Yes to save the changes.

-

Click No to return to the Payroll W2 Process Menu without saving the record.

-

Click Cancel to return the W2 Box Definition Code you are Editing.

Selecting

the  button displays the following options:

button displays the following options:

Then you are presented with the choice to print a listing of all W2 Box Definitions.

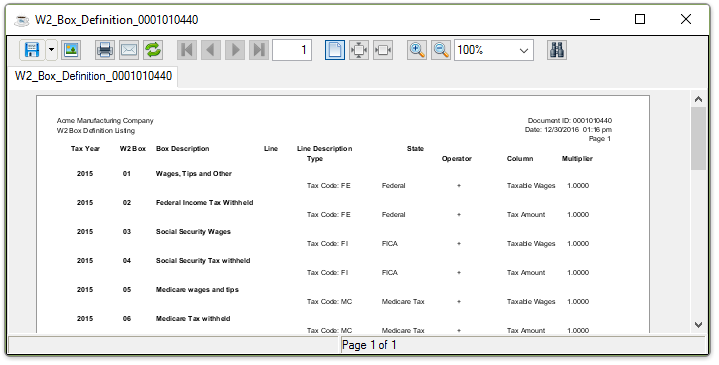

Sample W2 Box Definition Listing

See Output Options