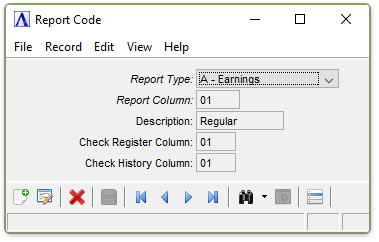

Payroll - Report Code Maintenance

Function

This task is used to set up and maintain codes identifying the headings and column locations used for printing information on payroll reports. Separate report codes are established for earnings, deductions, taxes, contributions, accruals, registers, exceptions, and check history reports. The Display additional options... button provides access for creating a Code Listing report.

To access this task...

Select Report Codes from the Inquiry and Maintenance menu.

Report Codes

About the Fields

Several different reports are produced by the Payroll module. System defined columns and headings are used in Status Reports, which detail current month, current quarter, and year-to-date dollars and units by employee. Certain other reports allow column locations (report codes) and report headings (descriptions) to be user defined.

(Refer to the table of reports featuring user-defined columns listed on the following page.)

Note:

The Register and Check History reports (types F and H) must be defined before any other report type.

From the Report Type dropdown...

Enter one of the following to identify the type of payroll information to be reported.

-

Select Earnings (A) if working with an Earnings Report.

-

Select Deductions (B) if working with a Deductions Report.

-

Select Taxes (C) if working with a Tax Report.

-

Select Contributions (D) if working with a Contributions Report.

-

Select Accruals (E) if working with an Accruals Report.

-

Select Register (F) if working with Register Reporting.

-

Select Exception (G) if working with an Exception Report.

-

Select Check History (H) if working with Check History Reporting.

-

Click

to select from a list of all defined report

codes.

to select from a list of all defined report

codes. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

In the Report Column field...

-

Enter a number from 01 to 07 to identify the report column where this type of information is to print.

As a guideline, refer to the following table of reports categorized by Report Type. Review the sample reports in Appendix A and have copies of each report below available for reference when defining report codes.

This table shows only those reports defined by this task:

| Report Type | Prints |

|---|---|

| A - Earnings |

Payroll Earnings Register Periodic Payroll Earnings History Report Payroll Distribution Report Periodic Payroll Distribution Report (Also refer to F-Registers and H-Check History) |

| B - Deductions |

Payroll Deduction Distribution Report (Also refer to F-Registers and H-Check History) |

| C - Taxes |

Payroll Tax Distribution Report (Also refer to F-Registers and H-Check History) |

| D - Contributions | Payroll Contribution Report |

| E - Accruals | Payroll Accrual Report |

| F - Registers |

Earnings, Deductions, and Taxes are printed on:

|

| G - Exceptions | Payroll Exception Report |

| H - Check History |

Periodic Payroll Check History Report Payroll Check Inquiry Screen Display |

Earning and deduction amounts are summarized under the headings of Earnings and Deductions on the Payroll Pre-Check Report, Check Register, Check History Report and Check Inquiry screen display. The columns for printing individual types of earnings and deductions on detail reports are assigned in the Pay Code Maintenance and Deduction Code Maintenance tasks. These columns are in turn assigned to a single column on the check reports and registers in the Register and Check History Column fields described below. On these same reports, taxes are detailed by type such as FICA and SDI. The columns assigned for each type of tax in Tax Code Maintenance task are also individually assigned in the Register and Check History Column fields. On payroll checks, all earnings, deductions and taxes are detailed.

In the Description field...

-

Enter a description of up to 10 characters to be used as a heading for the type of payroll information entered in the Report Type field.

In the Register Column field...

This field is only accessible for report types A, B, & C.

-

Enter a number from 01 to 07 to identify the column where this type of information is to print.

Enter the number of the column on the Payroll Pre-Check Report and Check Register where the information is to print. Earnings and deductions should be assigned to a single column, regardless of the number of types, since they are summarized on these reports. A separate register column should be defined for each individual type of tax.

In the Check History Column field...

This field is only accessible for report types A, B, & C.

-

Enter a number from 01 to 07 to identify the column where this type of information is to print.

Enter the number of the column on the Payroll Check History Report and Check Inquiryscreen display where the information is to print. Earnings and deductions should be assigned to a single column, regardless of the number of types, since they are summarized on these reports. A separate check history column should be defined for each individual type of tax.

When finished entering Report Code Information...

-

Click

to save the record.

to save the record. -

Click

to clear the form and begin again.

to clear the form and begin again. -

Click

to delete the record selected.

to delete the record selected.

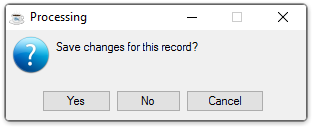

If the Window is closed without saving the record, the module issues this confirmation prompt:

Save changes for this record?

-

Click Yes to save the changes.

-

Click No to return to the Payroll Maintenance Menu without saving the record.

-

Click Cancel to return to the Report Code being edited.

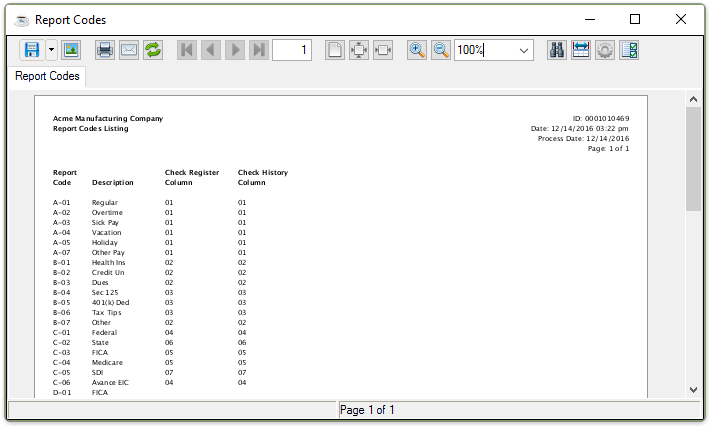

Selecting

presents the option to create a listing of all Report Codes:

presents the option to create a listing of all Report Codes:

Selecting this option creates the report:

Sample Report Codes Listing

See Output Options