Sales Order Processing - Sales Tax Report

Function

Use this task to print a report of taxable sales by month for each tax code used in the Order/Invoice Processing module. The tax percentage, taxable sales, tax amount, and gross sales amount are shown.

To access this task...

Select Sales Tax Report from the Period End Processing menu.

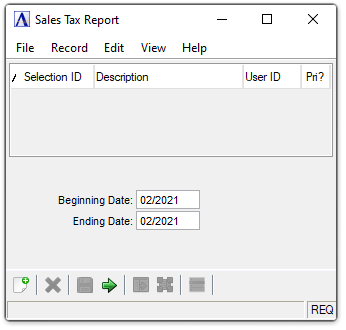

Sales Tax Report

About the Fields

In the Beginning Date field...

-

Enter the first date to appear on the report.

-

Click

to select a date by using the calendar tool.

to select a date by using the calendar tool.

In the Ending Date field...

-

Enter the last date to appear on the report.

-

Click

to select a date by using the calendar tool.

to select a date by using the calendar tool.

When finished making entries to the fields...

-

Click

to

save the date selections to rerun the report at a later time.

to

save the date selections to rerun the report at a later time. -

Click

to clear the entries and start again.

to clear the entries and start again. -

Click

to create the Sales Tax Report.

to create the Sales Tax Report.

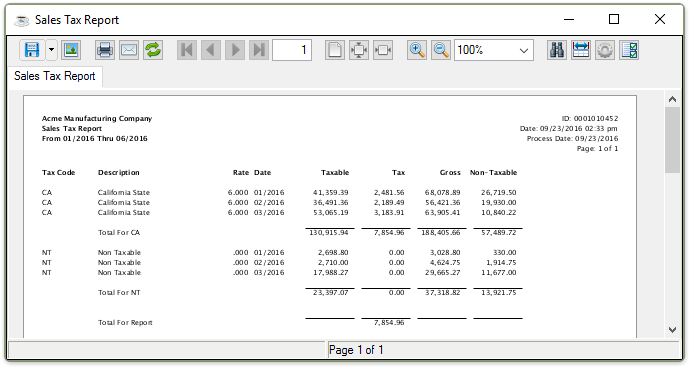

Sample Sales Tax Report

See Output Options.

Understanding the Sales Tax Report

The Sales Tax Report identifies some of the information necessary for completing the quarterly sales tax reports required by most states. When using a sales tax service, it is possible the Taxable and Tax amounts in the report do not match the amounts reported by the sales tax service. This can happen with Tax Codes that use a sales tax service if on-demand invoices are printed, or cash sales are made with the Tax Code while the sales tax service is not available. These transactions can be identified in the OPT_INVHDR table. They will have NO_SLS_TAX_CALC=1 and PRINT_STATUS=Y.

The meaning of each column is described below: