Accounts Receivable - Tax Code

Function

The Tax Code maintenance task allows for the creation, modification, deletion of Tax Codes.

To access this task...

Select Tax Code from the Inquiry and Maintenance menu.

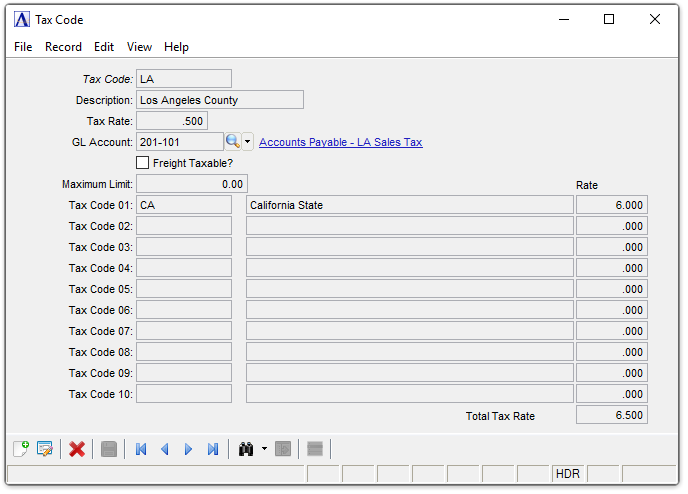

Tax Code

About the Fields

To

enable edits to the form select  .

.

In the Tax Code field...

-

Enter a new or existing two-character code, if the codes exists in the system the details, description, tax rate and GL Account, are displayed, otherwise the fields will be blank and new details can be entered.

-

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record. -

Use

to select from

a list of valid codes. See Query

Functions.

to select from

a list of valid codes. See Query

Functions.

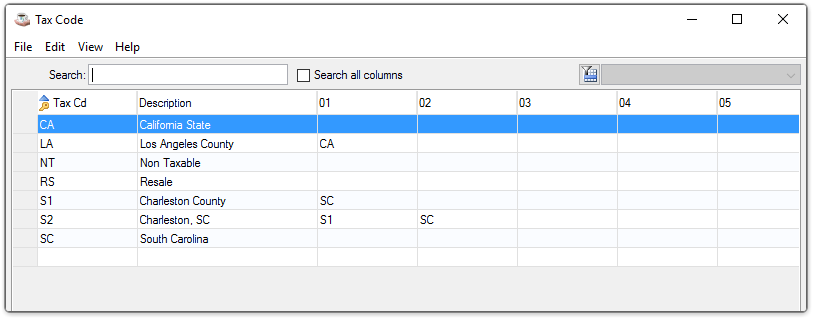

Tax Code Inquiry

See Query Functions.

In the Description field...

-

Enter description up to 20 characters in length.

In the Tax Rate field...

-

Enter a number to indicate the tax rate (as a percentage).

In the GL Account field...

-

Enter a valid GL Account number.

-

Click

to select from a list of valid GL Account codes.

to select from a list of valid GL Account codes.

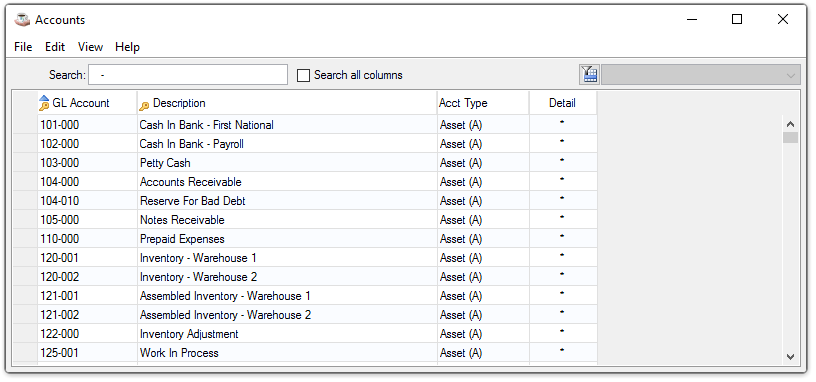

GL Account Codes Lookup

Freight Taxable? checkbox...

-

Mark the box to indicate taxable freight.

-

Unmark the box to indicate that freight is not taxed.

In the Maximum Limit field...

-

Enter an amount to set the limit of the tax.

In the Tax Code 01 to Tax Code 10 fields...

-

Enter a Valid tax code; the tax rate will display in the rate field against each tax code field.

-

Click

to select from a list of valid tax

codes.

to select from a list of valid tax

codes.

In the Total Tax Rate field...

Display only. The total tax rate is displayed in this field.

When done making selections...

-

Click

to save the new code.

to save the new code. -

Click

to clear

the form and begin again.

to clear

the form and begin again.

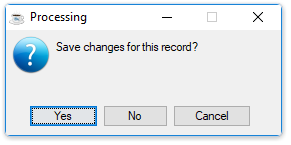

Attempting to leave an unsaved Tax Code by clicking New or Close Window, the module issues this confirmation:

Save changes for this record?

-

Click Yes to save the current record and return to the Tax Code field in the form.

-

Click No to return to the Tax Code field without saving the current record.