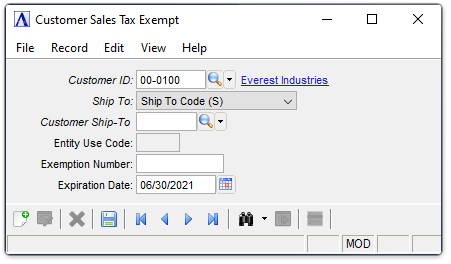

Accounts Receivable - Customer Sales Tax Exemptions

Function

The Customer Sales Tax Exemptions task is for storing sales tax Exemption Certificate information issued to a customer by a state, and/or an Entity Use Code from the sales tax service being used. Note that Exemption Certificates and Entity Use Codes are associated with the location where the sold items are being shipped.

To access this task...

Select Customer Sales Tax Exemptions from the Inquiry and Maintenance menu.

Customer Sales Tax Exemptions

About the Fields

To enable edits to the form select  .

.

In the Customer ID field...

-

Enter the valid customer number.

-

Click

to select a customer ID from a list of existing active code records.

To view a list of all records including inactive records, see Query

Functions.

to select a customer ID from a list of existing active code records.

To view a list of all records including inactive records, see Query

Functions. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

From the Ship To dropdown...

-

Select Bill To (B) if the ship to address is the same as the bill to address.

-

Select Ship To Code (S) if the ship to is a defined ship to address for the customer.

In the Customer Ship To field...

Disabled unless "Ship To Code (S)" is selected for the Ship To.

-

Enter a valid Customer Ship To code.

-

Click

to display defined customer ship to codes for this vendor.

to display defined customer ship to codes for this vendor.

In the Entity Use Code field...

- Enter valid Entity Use Code provided by the sales tax service being used.

In the Exemption Number field...

-

Enter valid Exemption Number of the state issued Exemption Certificate for the location where the sold items are being shipped.

In the Expiration Date field...

-

Enter expiration date of the state issued Exemption Certificate.

When done making selections...

-

Click

to save the new code.

to save the new code. -

Click

to clear

the form and begin again.

to clear

the form and begin again.

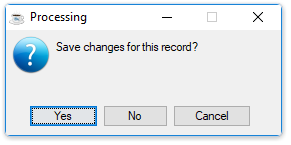

Closing an unsaved record will issue the prompt:

Save changes for this record?

-

Select Yes to save the changes.

-

Select No to return to the form.