Accounts Payable - Manual Check Entry

Function

Use this task to enter manual checks, void checks, and check reversals.

To access this task...

Select Manual Check Entry from the Accounts Payable main menu.

Manual Check Entry

About the Fields

The Manual Check Entry screen is divided into two sections. The upper section describes the check and vendor. The lower section describes invoice information. The fields used depends on the type of transaction being recorded (manual check entry, check void, or check reversal).

In the AP Type field...

This field is accessible only if the checkbox is selected in the Multiple AP Types parameter.

-

Enter a type code of the vendor for whom you are entering manual checks.

-

Click

to select from a list of existing type codes.

to select from a list of existing type codes.

In the Check No. field...

-

Enter a check number of up to 7 digits.

-

Click the Record Query button

to select

existing manual check entries records. See Query

Functions.

to select

existing manual check entries records. See Query

Functions. -

Click the record navigating buttons;

to view the first record,

to view the first record,  to view the previous record,

to view the previous record,  to view the next record, and

to view the next record, and  to view the last record.

to view the last record.

If the check number entered is an open manual check or computer check, the following message box appears:

This is an open computer or manual check. Create reversal?

-

Click Yes to make the transaction type a Reversal. If the check is not associated with the vendor selected above, the vendor changes to the vendor associated with the check.

-

Click No to clear the entry to enter a different check number.

From the Checking Account dropdown...

All Checking Accounts setup in Bank Account Codes maintenance are listed. Select the one to use for the check currently being entered. The Checking Accounts dropdown list is disabled when there is only one Checking Account.

From the Trans Type dropdown...

-

Select Manual (M) to record the accounting information from a check that was manually prepared (that is, not printed by the computer)

-

Select Reversal (R) to reverse a check, which reverses the payment record and general ledger postings (if General Ledger installed) of a check printed by or recorded in the Accounts Payable module (for example, a check was issued to a vendor and never cashed). Invoice will remain open for the vendor.

-

Select Void (V) to void a check. Void checks have not been updated in the Accounts Payable module (for example, a blank check was destroyed or lost).

NOTE:

If the Monthly Check file was cleared by Period End Update or by running the Purge Zero Invoices task, a check cannot be reversed with this process. Adjust the invoice in the Invoice Entry task, and when the General Ledger module is installed, make correcting journal entries to the general ledger.

In the Vendor field...

-

Enter a valid vendor number.

-

Click

to select from a list of existing vendor numbers.

to select from a list of existing vendor numbers.

NOTE:

Only the AP Type, Check Number, Transaction Type, and Check Date fields are used when voiding a check.

If a vendor number is entered for which the previously entered AP type is not valid, the following message appears:

Vendor not set up for this AP Type.

-

Click OK or "Close Window" button to return to the Vendor field.

In the Check Date field...

-

Enter the date for the transaction in mmddyyyy format.

-

Click

to select

a date by using the calendar tool.

to select

a date by using the calendar tool. -

Press Enter to accept default date which is current date.

When the General Ledger module is installed this date determines the general ledger posting date for the manual check and related invoices not previously entered through the Invoice Entry task. For voided checks, enter the date the check is to be recorded as void in the Monthly Check Register.

NOTE:

When the Post to Closed Periods parameter is unchecked, a check cannot be entered with a date that falls within a closed general ledger period.

In the Invoice field...

-

Enter alphanumeric characters for the invoice number.

-

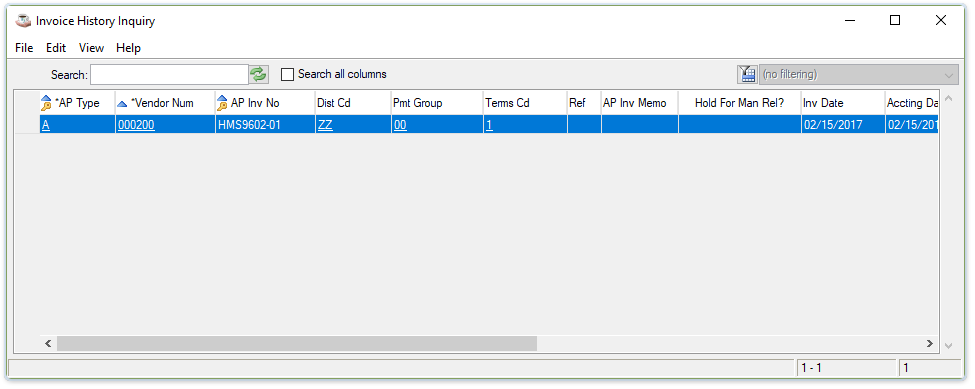

Select the Open Invoice button to view and select from a list of open invoices for this vendor.

Open Invoice Inquiry grid

If the invoice number was not previously entered, the module issues the prompt:

This invoice is not in the Open Invoice File

-

Click OK or

to proceed with entering the required invoice

information.

to proceed with entering the required invoice

information.

Since invoice numbers are not always unique, the Accounts Payable module creates a unique number by combining the invoice number with the vendor number. When entering an invoice number, the module verifies whether the invoice number/vendor number combination already exists.

When the invoice is in the Open Invoice file, the invoice information is displayed. An invoice amount of zero (.00) indicates that the invoice was paid.

CAUTION:

Check the invoice number if you think the invoice was entered through the Invoice Entry task, though the date and amounts are not displayed on the screen when you enter the invoice number. When you accidentally enter another invoice number, the invoice is posted twice. When using multiple accounts payable types, remember that the combination of accounts payable type, vendor, and invoice number are used to determine if the invoice is already in the Open Invoice file.

When an existing invoice is not found, you are advanced to the Date field.

In the Date field...

-

Enter the date for the invoice.

-

Click

to select

a date by using the calendar tool.

to select

a date by using the calendar tool.

In the DC field...

-

Enter a valid distribution code.

-

Click

to select from the list of available distribution codes.

to select from the list of available distribution codes.

When the Multiple Distributions parameter is checked, a valid distribution code must be entered. When the Multiple Distributions parameter is unchecked, then the Single Distribution Code specified in AP Parameters is assigned to the transaction.

In the Description field...

Display only. When a DC code is entered, the description for the code displays.

In the Memo field...

This field is disabled for existing invoices entered via AP Invoice Entry, and displays the Memo information entered for the invoice.

This field is enabled for new invoices NOT entered via AP Invoice Entry.

- Enter optional descriptive information for the invoice.

In the Inv Amt field...

-

Enter the invoice amount to be paid.

-

Press Enter to accept the amount displayed.

Payment cannot be made for more than the invoice amount that is displayed. You must use the Invoice Entry task to adjust the invoice to a larger amount before an increased payment amount is allowed. To specify a partial payment, enter a lesser amount here.

NOTE:

Invoices can be entered either through the Invoice Entry task (in which case they may be referred to as Open) or through Manual Check Entry. Manual Invoices allow the user to quickly enter and pay an invoice, bypassing the full detailed invoice entry. However, partial payments cannot be made to a Manual Invoice. Any unpaid amount of a manual invoice will need to be entered separately through the Invoice Entry task.

Invoice Amount Example for Invoices Entered Through Invoice Entry

An invoice for $100 was entered into Invoice Entry (Inv # 1234567890). To make a partial payment of $60, less a $5 discount, enter 1234567890 in the Invoice Number field (make sure the AP type and vendor number correspond to those entered in theInvoice Entry). Enter the $60 in theInvoice Amount field and $5 in the discount field. The actual payment is a $55 manual check. The unpaid balance of $40 appears on the Aging Report after the check is updated.

Invoice Amount Example for Invoices Entered Through Manual Check Entry

To enter a partial payment of $60 on an invoice for $100 with a $5 discount through Manual Check Entry, enter the invoice in the Invoice Number field, $60 in the Invoice Amount field, $5 in the Discount field. Total payment is $55. If the outstanding $45 needs to be recorded in the system, enter an invoice for $45 through Invoice Entry.

In the Disc Amt field...

Enter the amount of the discount taken.

In the Retention Amt field...

This field is displayed only when the Retention parameter is checked.

Display only. Shows the amount of retention as entered in the Invoice Entry task.

The retention amount, when present, is subtracted from the payment amount. The retention amount cannot be included in the first payment on an invoice. On subsequent payments, the retention amount is included in the invoice amount and payment can be made.

When a manual check is used to pay an invoice not previously entered into the Accounts Payable module, the distributions must be entered. The total amount that must be distributed is shown in the Distribute field and the sum of the distribution amounts must match this total before the entry is complete.

In the Net Paid field...

Display only. Shows the amount of payment for the invoice minus the discount.

The Load Image and View Images buttons...

The Load Image lets you specify one or more images you've scanned to associate with an invoice, and the View Images lets you see what's been linked to the invoice

The Print Check button...

When checked, prints an on-demand check for the entered manual check and invoices. Check can be printed with or without a MICR band at the bottom. See Appendix C for more information.

After completing the distribution details...

-

Click

to save the distribution details.

to save the distribution details. -

Click

to delete

the current line of Distribution record.

to delete

the current line of Distribution record. -

Click

to return

to the Manual Check Entry screen after changing, saving, or deleting

the distribution records.

to return

to the Manual Check Entry screen after changing, saving, or deleting

the distribution records.

The module compares the value of the Distribute field to the total of the distribution lines. When the invoice amount is fully distributed, the entered distribution information is accepted. The task returns to the Invoice No field where information is entered for the next invoice to be paid with the check. When the two amounts do not balance, the module issues the prompt:

Amount distributed to GL doesn't match invoice amount!

-

Click OK to adjust the amounts on the distribution lines to balance to the invoice amount.

After Finishing the manual check entries...

-

Click

to save the manual check entry.

to save the manual check entry.

-

Click

to clear the form and begin again.

to clear the form and begin again.

-

Click

to delete the current manual check entry.

to delete the current manual check entry.