Accounts Payable - Check Register

Function

The Check Register lists all the vendor checks (including void checks) that were printed in the most recent batch of computer-printed checks. The list is in check number order. When the register is printed and verified, the update process begins. It creates the general ledger postings, posts payments to the Vendor Master file and Disbursement History file, and optionally updates the bank reconciliation files.

To access this task...

Select Check Register from the Accounts Payable main menu.

NOTE:

Create the register only after checks are printed for the selected payments.

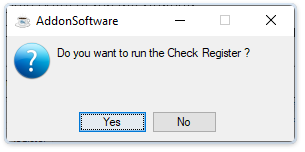

Do you want to run the Check Register?

-

Click Yes to run the register.

-

Click No or the "Close Window" button to return to the Accounts Payable Processing menu.

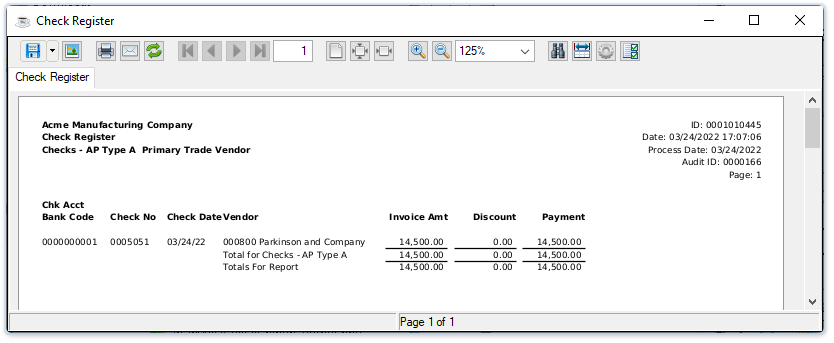

Sample Check Register

See Output Options.

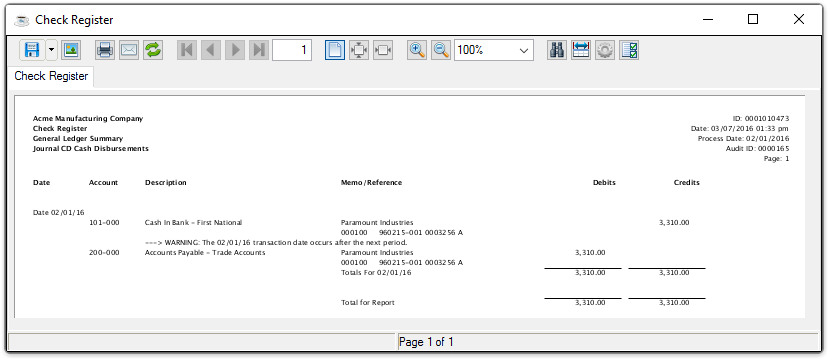

Depending upon your particular configuration, the system may produce a GL summary report.

Sample Check Register GL Summary

See Output Options.

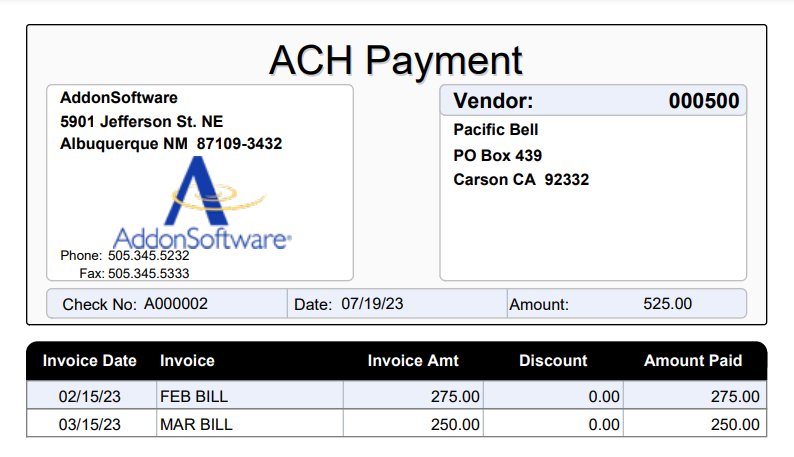

If processing ACH payments, the check register also generates a Vendor Payment report summarizing the payment(s) paid to the bank for a given vendor. This report can be printed and mailed or emailed via Report Control.

The system then asks the user if the register update should be run.

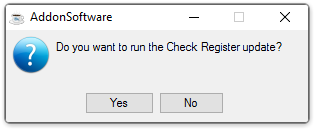

Do you want to run the Check Register update?

-

Select Yes to run the check register update.

-

Select No to skip the update step.

The update has the following effects:

-

The checks are added to the files accessed by the Monthly Check Report and Disbursements Journal.

-

The vendor payment history is updated for each vendor that was paid.

-

A payment record is written to the Open Invoice file for each check processed.

-

The General Ledger Daily Detail file is updated according to the distribution codes associated with the invoices during the invoice entry process. If the Accounts Payable module is on an accrual basis, the total amount paid during the check run is debited to the accounts payable account(s). On a cash basis, the appropriate expense account is debited. The cash account is credited, and the discounts-taken account is credited by the amount taken in discount.

-

When the Bank Reconciliation parameter is selected in the Accounts Payable Maintenance task, the check numbers are posted to the proper bank account (as identified by the general ledger cash account(s) being posted.

-

If this batch of checks included ACH payments, the NACHA file is created for transmission to the bank.